OFF THE WIRE

BY: Bart Madson, Be it bike tests, feature stories or racing reports Madson has been scribbling at Motorcycle USA for almost a half decade. He rides whatever’s in the MCUSA garage - just don’t ask him to wheelie.

Source: motorcycle-usa.com

Documents released by the Federal Reserve disclose who benefited from a government loan program during the financial crisis of 2008. The data shows what companies the Federal Reserve purchased commercial paper from with its Commercial Paper Funding Facility (CPFF). Among those accepting the credit boost was motorcycle manufacturer Harley-Davidson. The Motor Company took the Fed up on its emergency lending on 33 separate occasions in 2008 and 2009 to the tune of $2.3 billion.

Commercial paper is a routine short-term funding method for companies to cover operating expenses, like payroll and rent. Increases in the issuing of commercial paper can be seen as a positive sign, as companies may be generating the funds to ramp up production and pay new hires and increase inventories. During the credit crisis in 2008, this positive scenario was not the case. The normally liquid commercial paper market had frozen with risk-averse private investment sources, like mutual funds, unwilling to lend.

The government, in the form of the Federal Reserve, stepped in with the establishment of the CPFF in October 2008. The Federal Reserve Bank of New York created the CPFF Limited Liability Company, which administered the paper purchase program. It began lending (by purchasing the beleaguered company’s issued commercial paper) on October 27, 2008 and closed on February 1, 2010. The last of the commercial paper purchases matured on April 26, 2010, as the loans were repaid with interest and fees. The CBFF LLC was dismantled four days later.

Provisions in the Dodd-Frank financial reform bill, passed earlier this year, required the public disclosure of the CPFF loans by December 1, 2010. The full purchase list (available in a spreadsheet at the Federal Reserve website: www.federalreserve.gov/newsevents/reform_cpff.htm) reveals financial giants like Citigroup, Morgan Stanley and AIG snatched up the majority of the fed money. Harley-Davidson, however, was one of a number of major American brands that also benefited from the CPFF funding lifeline, along with Caterpillar, McDonalds, GE and Verizon.

The total amount of Harley-Davidson commercial paper purchased by the government totaled $2,320,600,000. The 33 total paper purchases followed two major waves, with daily purchases as the program began on October 27 through October 31 - the first purchase being the largest at $148.9 million. Harley then issued paper sporadically throughout November and December of 2008.

A second wave of paper was issued three months later as the first round reached the to maturity date, beginning January 26 2009. The paper amounts of the second wave correspond roughly with many of the original paper amounts. The last commercial paper issuance by H-D to the CPFF was February 11, 2009.

As its final government paper was purchased, Harley-Davidson received an injection of long-term funding from a notable private investment source, Warren Buffet. The billionaire delivered $300 to H-D on February 4, 2009. The bond purchase requires Harley to pay 15% annual interest, with the bonds maturing in 2014.

The credit crisis was a primary source of Harley-Davidson’s financial woes, as the company’s Financial Services arm hemorrhaged losses. The HDFS lost $24.9 million in Q4 of 2008, and $118 million total in 2009. HDFS is critical to Harley’s success as it finances a majority of the company’s consumer purchases.

skip to main |

skip to sidebar

Bill & Annie

Art Hall & Rusty

NUFF SAID.......

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

GIVING BACK

MOUNT SOLEDAD

BIKINI BIKE WASH AT SWEETWATER

FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

hanging out

brothers

GOOD FRIENDS

Good Friends

Hanging Out

Bill & Annie

Art Hall & Rusty

Art Hall & Rusty

NUFF SAID.......

NUFF SAID......

Mount Soledad

BALBOA NAVAL HOSPITAL

RUSTY DANNY

ANNIE KO PHILIP

PHILIP & ANNIE

OUT & ABOUT

OOHRAH...

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

ONCE A MARINE,ALWAYS A MARINE

American Soldier Network GIVING BACK

GIVING BACK

CATHY & BILL

PHILIP & DANNY & BILL

MOUNT SOLEDAD

bills today

EMILIO & PHILIP

WATER & POWER

WATER & POWER

bootride2013

BIKINI BIKE WASH AT SWEETWATER

ILLUSION OPEN HOUSE

FRIENDS

GOOD FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

GOOD FRIENDS

Friends

- http://www.ehlinelaw.com/losangeles-motorcycleaccidentattorneys/

- Scotty westcoast-tbars.com

- Ashby C. Sorensen

- americansoldiernetwork.org

- blogtalkradio.com/hermis-live

- davidlabrava.com

- emiliorivera.com/

- http://kandymankustompaint.com

- http://pipelinept.com/

- http://womenmotorcyclist.com

- http://www.ehlinelaw.com

- https://ammo.com/

- SAN DIEGO CUSTOMS

- www.biggshd.com

- www.bighousecrew.net

- www.bikersinformationguide.com

- www.boltofca.org

- www.boltusa.org

- www.espinozasleather.com

- www.illusionmotorcycles.com

- www.kennedyscollateral.com

- www.kennedyscustomcycles.com

- www.listerinsurance.com

- www.sweetwaterharley.com

Hanging out

hanging out

Good Friends

brothers

GOOD FRIENDS

EMILIO & SCREWDRIVER

GOOD FRIENDS

Danny Trejo & Screwdriver

Good Friends

Navigation

Welcome to Bikers of America, Know Your Rights!

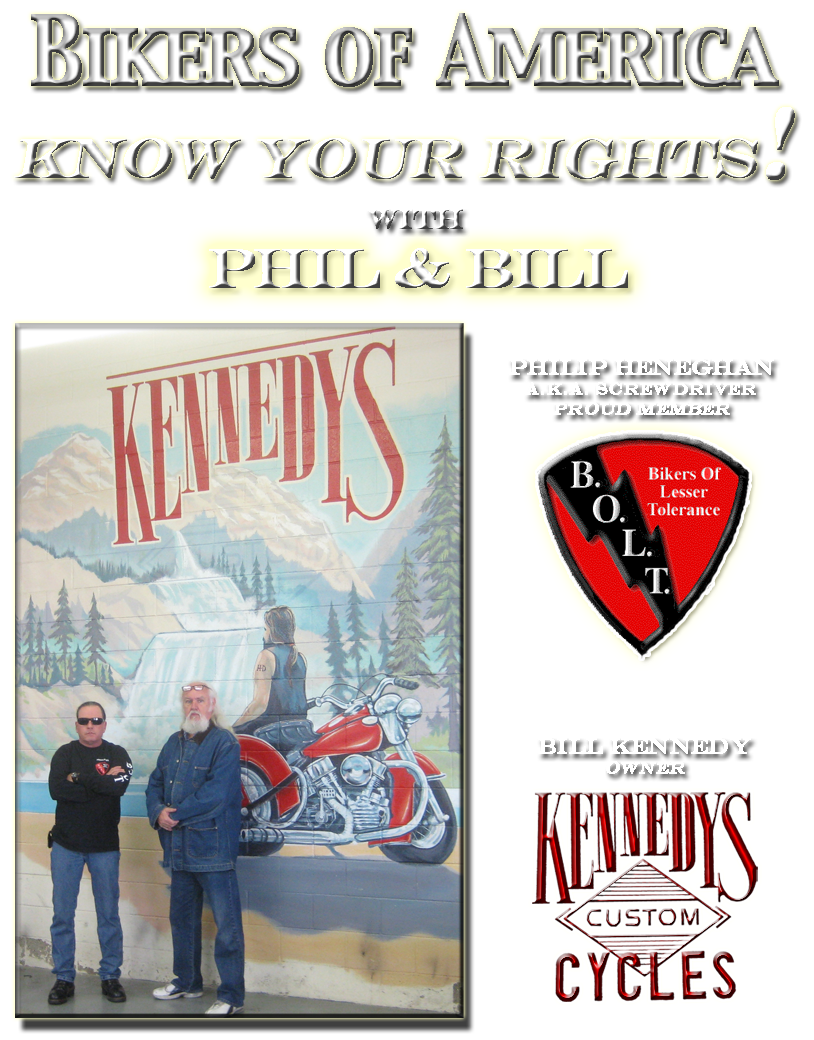

“THE BIKERS OF AMERICA, THE PHIL and BILL SHOW”,

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

Good Times

Hanging Out

Key Words

- about (3)

- contact (1)

- TENNESSEE AND THUNDER ON THE MOUNTAIN (1)

- thinking (1)

- upcoming shows (2)

Blog Archive

-

▼

2010

(4242)

-

▼

December

(595)

- No title

- Canada - TRURO - Startling developments in decade-...

- LOCALS FORGE LAW TO FIGHT MOTORCYCLE THEFT

- DUI - Do you feel your state DUI laws are too stiff?

- Policing the police: No oversight - 2nd Installmen...

- With ‘Sovereign Citizen’ Movement Growing, New SPL...

- UPCOMING EVENTS

- Two indicted on gang-related charges

- FUCK YOU ! Neither 'good' nor 'bad,' fatal police ...

- Fiber Optic Mohawk Helmets. Not For Me. For You?

- CA: Drivers Angered by Freeway Campaign Promoting ...

- JUSTICE DENIED FOR A DISABLED VIETNAM ERA VETERAN ...

- National Police Misconduct NewsFeed Daily Recap 12...

- Canada - Whynott to make court appearance this aft...

- Georgia - Biker babes aid troops, charity

- Scott City, MO - Boot-Heel Harley-Davidson Gives T...

- Australia - Sydney tattoo parlour firebombed

- Australia -Sad loss of a charitable man

- Maine AG: ATF agents justified in shooting biker.....

- California - New state law aims to curb motorcycle...

- Missouri - Patriot Guard bikers proud to block Wes...

- Pro-Gun Argument . . .

- CALIFORNIA - New Motorcycle Law Revs Up Controvers...

- F.Y.I. - FREEDOM OF INFORMATION ACT.......

- Australia - Rival bikie gangs up the ante - Coman...

- National Police Misconduct NewsFeed Daily Recap 12...

- WASHINGTON - DEA transformed into global intellige...

- PROJECT - " NOT GIULTY "

- Happy New Year and Mark Your Calendars for the 201...

- A Premature Alarm Regarding Police Fatality Rates

- FABIAN v. FULMER HELMETS, INC.

- House Checks?

- PROJECT - " NOT GIULTY "

- UNITED STATES - Feds To Require Gun Sale Notificat...

- HARLEY RIM FAILURE!

- Arizona - KINGMAN - 7 alleged Vagos indicted

- The FCC's Threat to Internet Freedom

- 2010 Motorcycle Helmet laws a federal issue again???

- New state laws change rules on drinking, handgun a...

- Scientific Research,Study: Fellatio may significan...

- Back-seat Driver: California toughens motorcycle l...

- ATTIKA7

- New legislation that could potentially affect MC p...

- “THE BIKERS OF AMERICA - THE PHIL AND BILL SHOW”

- California - Santa Clara cop now faces federal cha...

- BOLT of Iraq???

- Last Night's Activism

- Germany - Hells Angels on the rise

- ~ Living Legends ~ Lithograph & Book Signing

- LINKS TO SHARE:

- FABIAN v. FULMER HELMETS, INC.

- U.S. - Monitoring America - "See Something, Say S...

- TENNESSEE: Appeals court orders reconsideration of...

- Pittsburgh officer charged in fatal Sept. crash

- KENTUCKY: This years Ride for Freedom 2011 will be...

- VETERANS BENEFITS ACT OF 2010 SIGNED INTO LAW.

- January 8, 2011 Los Angeles, CA Easyriders Bike Sh...

- More rights stolen!! Now it's the internet!! Thank...

- Washington DC - House to read Constitution - 'We t...

- Fourth Amendment Rights

- Federal helmet recommendation could affect motorcy...

- Motorcycle Helmet laws a federal issue again???

- Off-duty San Diego police officer shoots suspect t...

- New legislation that could potentially affect MC p...

- MEMPHIS, Tenn. (AP) — An appeals court has ruled t...

- Cops' Use of Illegal Steroids a 'Big Problem'

- California Gun Laws: APPEAL FILED IN LAWSUIT CHALL...

- “HERMIS LIVE!”-INTERNET RADIO SHOW-BIKERS: MODERN ...

- OUT OF CONTROL - Cheektowaga, NY - Use of Taser br...

- Winter Motorcycle Tire Tips From Dunlop

- Oklahoma - Police corruption probe to deepen in 2011

- Harley-Davidson, Inc. to report fourth quarter ear...

- UPDATE - Top stories of 2010

- Cyprus - Bikie paymaster faces extradition

- UPDATE - Outlaw bikers convicted in RICO case

- UPDATE - Sex trafficking victims at massage parlor...

- A massage parlor eviction incident in Irvine, CA r...

- HPD Officer Probed in Pill Mill

- Georgetown man says police officer kicked him, bro...

- Pocono, PA - Angels in leather embody spirit of Ch...

- Australia - Rebels bikie citadel up for sale

- California - Former Bell Cop Gets Nine Years in Pr...

- Australia - Christmas party like no other..........

- Australia - Top fugitive nabbed in Cyprus

- National Police Misconduct NewsFeed Daily Recap 12...

- AMA ACTION ALERT - New Omnibus Public Lands Bill i...

- Australia - Bikie sign a hoax: owners

- IMPORTANT NEWS - CNN Breaking News House OKs measu...

- Australia - Gunman 'was taking shots at strip club'

- New rules may result in no fireworks

- INTERNATIONAL NEWS: Jamaica - Police get motorcyc...

- Biker/Santa inspires Club to Hold Toy Drive....

- IOWA: Motorcycle helmets should be required by law

- Australia - Alleged biker bans himself from pubs

- Outlaws Motorcycle Gang Members Found Guilty

- New York - Celebration to recall life of Fran Zygl...

- CHARLESTON, W.Va. - Former prison guard sentenced ...

- CHARLESTON, W.Va - Man who sold cocaine to Pagans ...

- INTERNATIONAL NEWS: Jerusalem - Avi Cohen's injury...

- Illinois - CHICAGO - 'Large Guy' convicted in Chic...

-

▼

December

(595)

Bikers of America, Know Your Rights!... Brought to you by Phil and Bill

Philip, a.k.a Screwdriver, is a proud member of Bikers of Lesser Tolerance, and the Left Coast Rep

of B.A.D (Bikers Against Discrimination) along with Bill is a biker rights activist and also a B.A.D Rep, as well, owner of Kennedy's Custom Cycles