Off the Wire

Health Care Mandate to Be Enforced by IRS 'Bounty Hunters'

By Jim Kouri - BLN Contributing Writer

"Of all tyrannies, a tyranny sincerely exercised for the good of its victims may be the most oppressive. It would be better to live under robber barons than under omnipotent moral busybodies. The robber baron's cruelty may sometimes sleep, his cupidity may at some point be satiated; but those who torment us for our own good will torment us without end for they do so with the approval of their own conscience."—C. S. Lewis (1898 - 1963)

The Internal Revenue Service (IRS) will see its largest expansion since withholding taxes were first enacted during WWII to enforce the glut of new tax mandates and penalties included in the Democrats' latest health care plan, according to Rep. Kevin Brady (R-TX)

A new analysis by the Joint Economic Committee and the House Ways & Means Committee minority staff estimates up to 16,500 new IRS personnel will be needed to collect, examine and audit new tax information mandated on families and small businesses in the `reconciliation' bill being taken up by the U.S. House of Representatives this weekend, according to Brady.

"When most people think of health care reform they think of more doctors exams, not more IRS exams," says U.S. Congressman Kevin Brady, the top House Republican on the Joint Economic Committee. "Isn't the federal government already intruding enough into our lives? We need thousands of new doctors and nurses in America, not thousands more IRS agents."

Scores of new federal mandates and fifteen different tax increases totaling $400 billion are imposed under the Democratic House bill. In addition to more complicated tax returns, families and small businesses will be forced to reveal further tax information to the IRS, provide proof of `government approved' health care and submit detailed sales information to comply with new excise taxes.

Scores of new federal mandates and fifteen different tax increases totaling $400 billion are imposed under the Democratic House bill. In addition to more complicated tax returns, families and small businesses will be forced to reveal further tax information to the IRS, provide proof of `government approved' health care and submit detailed sales information to comply with new excise taxes.

Unfortunately, according to the Center for American Progress, the structure of the IRS' use of private agencies to collect "debts" encourages abuse. Under the current program, collectors are awarded as much as 25 cents of every dollar they collect, in addition to a $100 bonus for every account they close.

The Internal Revenue Service strategy of paying private debt collectors a 25 percent commission to collect unpaid tax debt originally met with bipartisan resistance from Congress. They claimed that the proposal jeopardized the rights and privacy of American taxpayers. Several organizations voiced their objections to the IRS proposal and have expressed their strong support for the consumer protection legislation Rep. Chris Van Hollen introduced: Citizens for Tax Justice, Consumer Federation of America, Consumers Union, National Consumer Law Center, National Consumers League.

The very nature of the program provides incentives for collectors to push the limits of legality to extract a little more revenue from their targets. As part of the IRS Restructuring and Reform Act of 1998, Congress, fearing overly aggressive collection practices, explicitly prohibited the IRS from compensating its own collectors based on the amount of money they collect. If Congress believes that incentive-based pay will cause official IRS collectors to cross the line, why would they think private collectors would behave any differently?

Although IRS officials indicated that the purpose of the limited implementation phase was to assure readiness for full implementation using up to 12 private collection agencies, the IRS has not documented how it will identify and use the lessons learned to ensure that each critical success factor is addressed before expanding the program even further during the current atmosphere of extraordinary government spending.

Because program's success will be affected by how well IRS makes adjustments, assessing the lessons learned in limited implementation is critical. Also, IRS has not documented criteria that it will use to determine whether the limited implementation performance warrants program expansion.

IRS officials indicated that they are considering criteria that could trigger a go/no go decision, such as the amount of penalties collected from Americans unwilling or unable to purchase health care insurance and there are some indications of PCAs abusing taxpayers or misusing taxpayer data.

Paying private debt collectors on a commission basis is costly and threatens the rights and privacy of the American taxpayers. Congress must ensure, as this resolution seeks to do, that federal tax collection functions will not be handed over to private sector bounty hunters.

Critics of the private collection agency program say that, compared with private debt collectors, whose bad apples star in countless horror stories of debtor abuse and intimidation, the IRS's customer-service-based approach may start looking pretty good to taxpayers.

A recent Center for American Progress report noted that "19% of all complaints received by the Federal Trade Commission (FTC) in 2005 were related to debt collectors, up from 10.5% in 1999. The FTC received more complaints about debt collection in 2005 than about any other industry—66,627, a 560% increase over the last six years." The report's writers claim this will likely occur with private agencies working on behalf of the IRS.

IRS officials say they will have a little more than a half year to identify the lessons learned before incorporating them into the next contract solicitation, which IRS intends to release in March 2007.

Related to such decisions on expansion is IRS's planned comparative study of using PCAs. That study is to compare using PCAs to investing IRS's operating costs into having IRS staff work IRS's "next best" collection cases. Under the documented study design, IRS would exclude the fees paid to PCAs from the costs and subtract those fees from the tax debts and health care penalties collected by PCAs.

While such a study might produce useful information, it will not compare the results of using PCAs with the results IRS could get if given the same amount of resources, including the fees to be paid to PCAs, to use in what IRS officials would judge to be the best way to meet tax collection goals.

Adequately designing and implementing the study is important to ensure policymakers are aware of the true costs of contracting with PCAs and know whether PCAs offer the best use of federal funds, while using the least abusive and intrusive tactics to collect tax money owed.

But taxpayer advocate Nina Olsen says that collecting tax revenue is the core job of the IRS, and it should continue to bear that responsibility while protecting taxpayer rights. IRS employees cost only 3 cents for every dollar they collect, making them many times more cost-effective than private collectors.

________

Jim Kouri, Vice-president of the National Association of Chiefs of Police. Jim writes for many police and crime magazines including Chief of Police, Police Times, The Narc Officer, Campus Law Enforcement Journal, and others.

__._,_.___

skip to main |

skip to sidebar

Bill & Annie

Art Hall & Rusty

NUFF SAID.......

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

GIVING BACK

MOUNT SOLEDAD

BIKINI BIKE WASH AT SWEETWATER

FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

hanging out

brothers

GOOD FRIENDS

Good Friends

Hanging Out

Bill & Annie

Art Hall & Rusty

Art Hall & Rusty

NUFF SAID.......

NUFF SAID......

Mount Soledad

BALBOA NAVAL HOSPITAL

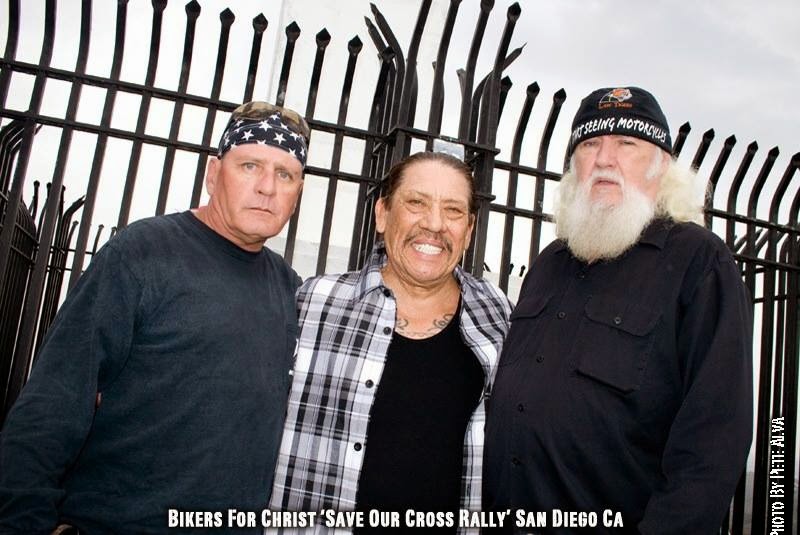

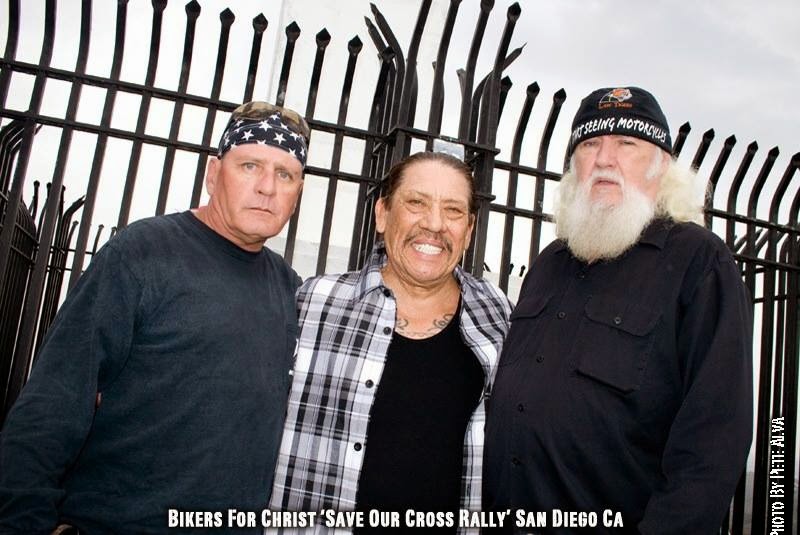

RUSTY DANNY

ANNIE KO PHILIP

PHILIP & ANNIE

OUT & ABOUT

OOHRAH...

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

ONCE A MARINE,ALWAYS A MARINE

American Soldier Network GIVING BACK

GIVING BACK

CATHY & BILL

PHILIP & DANNY & BILL

MOUNT SOLEDAD

bills today

EMILIO & PHILIP

WATER & POWER

WATER & POWER

bootride2013

BIKINI BIKE WASH AT SWEETWATER

ILLUSION OPEN HOUSE

FRIENDS

GOOD FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

GOOD FRIENDS

Friends

- http://www.ehlinelaw.com/losangeles-motorcycleaccidentattorneys/

- Scotty westcoast-tbars.com

- Ashby C. Sorensen

- americansoldiernetwork.org

- blogtalkradio.com/hermis-live

- davidlabrava.com

- emiliorivera.com/

- http://kandymankustompaint.com

- http://pipelinept.com/

- http://womenmotorcyclist.com

- http://www.ehlinelaw.com

- https://ammo.com/

- SAN DIEGO CUSTOMS

- www.biggshd.com

- www.bighousecrew.net

- www.bikersinformationguide.com

- www.boltofca.org

- www.boltusa.org

- www.espinozasleather.com

- www.illusionmotorcycles.com

- www.kennedyscollateral.com

- www.kennedyscustomcycles.com

- www.listerinsurance.com

- www.sweetwaterharley.com

Hanging out

hanging out

Good Friends

brothers

GOOD FRIENDS

EMILIO & SCREWDRIVER

GOOD FRIENDS

Danny Trejo & Screwdriver

Good Friends

Navigation

Welcome to Bikers of America, Know Your Rights!

“THE BIKERS OF AMERICA, THE PHIL and BILL SHOW”,

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

Good Times

Hanging Out

Key Words

- about (3)

- contact (1)

- TENNESSEE AND THUNDER ON THE MOUNTAIN (1)

- thinking (1)

- upcoming shows (2)

Blog Archive

-

▼

2010

(4242)

-

▼

March

(318)

- Report From Arizona

- ABATE LOCAL 6 MONTHLY BUSINESS MEETING

- Obama Steps Up Confrontation

- Request Human Rights Assistance & Proposed Amendme...

- Ariz. bill would let motorcyclists weave through P...

- B.C. to change motorcycle licensing

- Illinois Senate rejects law requiring youth motorc...

- “THE BIKERS OF AMERICA,THE PHIL AND BILL SHOW”

- Memo to my Friends

- BOTH HOUSE AND SENATE HEALTH BILLS REQUIRE THE MIC...

- Hells Angels kids’ club

- Comancheros believed to have smashed Holden Commod

- Angels ordered to quit Amsterdam territory

- Mongols biker pleads not guilty to acts with minor

- Bandidos bikie pleads not guilty

- Lone Wolf bikie jailed for 16 years for cutting of

- Germany goes full throttle against biker gangs aft

- Call to Action

- The B.A.D. Perspective

- Mission Statement

- Ex-Highwaymen leader pleads guilty to racketeering

- More than mobs to worry about

- to screwdriver@alphabiker.comccstrokerz383@gmail.c...

- Pagans want seized material barred from trial

- Bikie to take stand on Monday

- Hemet residents rally in support of city, law enfo

- Bikers had secret police documents, court hears

- "B.A.D." Work

- Power outage a chuckle

- Our sister needs your support,regarding Janet Hoga...

- “Two Wheel Thunder” with motorcycle Icons, Michele...

- Longtime biker sentenced to 15 years in prison

- Bandidos gang in turmoil after arrests

- Truck torchings may be latest attack on Hemet police

- Police Gear Up For Third Annual Motorcycle Safety ...

- Ex-Highwaymen leader pleads guilty to racketeering

- As we prepare for our inaugaral Support Jam this S...

- MI helmet law statistics

- Sparks Police Cite 68 for Lack of Proof of Insurance

- Our sister needs your support

- Helmet court

- Michigan HB 4747 (CLEAN BILL) House vote tomorrow.

- Here are the TACTICs government now uses against you

- Latest Drug in Middle School - 'Dusting' YOU MUST ...

- S3081 Enemy Belligerent Interrogation, Detention, ...

- Helmets - No List No Law effort in NY

- Medical marijuana users risk job loss

- Jesse James CHEATER!! NUDE PIX OF MISTRESS

- I.E. police blame motorcycle club of threats

- Sentencing is delayed for Virginia businessman in ...

- Biker Club Members Keep Salem Home From Going Up i...

- Skid-lid bikers shielded by helmet standards

- The American Veterans Traveling Tribute Wall

- Samuel Adams

- More U.S. "Traitor" countries moving to China

- Latest from Florida

- Unless it has MG as part of the rocker, it's a clu...

- “THE BIKERS OF AMERICA,THE PHIL AND BILL SHOW”

- CONTINUED,Southern Oregon Motorcycle Club Member S...

- Son of Pagans vice president held pending trial

- Southern Oregon Motorcycle Club Member Sentenced

- Real answer to your Theology question from a chemi...

- Gangs ?

- Health Care Mandate to Be Enforced by IRS 'Bounty ...

- Southern Oregon Motorcycle Club Member Sentenced

- SHOW and BLOG

- Riverside CA

- CONTINUED READ ON !!!!From: China Drawing High-Te...

- More U.S. "Traitor" countries moving to China

- Motorcycle club collects for veterans, children

- Who Voted How

- Presley takes aim at Outlaws again

- Son of Pagans vice president held pending trial

- Motorcycle club collects for veterans, children

- Legislation intended to help regulate motorcycle n...

- B.C. to change motorcycle licensing

- Motorcycle riders may be sent to driver school

- Get Your $2 DOT Chinese Helmets Here!

- Florida received 1 million dollars!! WHERE DID IT ...

- another bill to "protect you"?

- Doc's Freedom Ride

- Theological question

- HR 645 / U.S. Preparing For Civil Unrest

- NYC cops sorry for pounding couple's door 50 times

- Illinois Senate rejects law requiring youth motorc...

- Ariz. bill would let motorcyclists weave through P...

- California declares war on biker gang accused of '...

- Youtube Videos of Illusion Motorcycles

- Defeat of SB 2535 (under 18 motorcycle helmet bill)

- New World Order and Motorcycle Clubs

- Thousands of motorcyclists protest in France

- Need an answer to a question

- Get Your $2 DOT Chinese Helmets Here!

- US Department of Transportation Calls For End to A...

- HOUSE COMMITTEE APPROVES LANE SPLITTING IN ARIZONA

- Hells Angel charged after cash found

- Stunt Rider defies grim reaper

- Traveling Vietnam Veterans Wall stops in Lawton

- Harley-Davidson Stock Price Surged On Takeover Spe...

- Patriot Guard Riders raise money for flight

-

▼

March

(318)

Bikers of America, Know Your Rights!... Brought to you by Phil and Bill

Philip, a.k.a Screwdriver, is a proud member of Bikers of Lesser Tolerance, and the Left Coast Rep

of B.A.D (Bikers Against Discrimination) along with Bill is a biker rights activist and also a B.A.D Rep, as well, owner of Kennedy's Custom Cycles