Biker Rights Issues

Total Refunds to Consumers Now Approaching $20 Million

BOSTON – Today, Attorney General Martha Coakley’s Office reached settlements with four more auto insurance companies regarding allegations that the insurers overcharged Massachusetts consumers for motorcycle insurance. The settlements, which are expected to return $9 million to consumers, allege that Metropolitan Property & Casualty Insurance Company, Plymouth Rock Assurance, Pilgrim Insurance Company and the United Services Automobile Association (“USAA”) used inflated motorcycle values to calculate premiums for many of their Massachusetts customers, resulting in millions of dollars in insurance premium overcharges. The Attorney General’s Office reached similar settlements with Safety Insurance Company, Liberty Mutual, and Quincy Mutual in January of this year. In total, the seven insurers are expected to return $20 million to consumers and pay over $1 million to the Commonwealth.

“We are pleased that these insurance companies will return $9 million in insurance premium overcharges to affected motorcycle owners,” said Attorney General Martha Coakley. “While we appreciate that these companies cooperated with our investigation, it remains troubling that they systemically overcharged their customers on such a large scale. Our office will continue to investigate other companies engaged in this type of behavior. In order to thwart and correct practices like this, consumers and regulators need transparency and access to information in the auto insurance rating process.”

Under the terms of the settlements, filed today in Suffolk Superior Court, it is anticipated that Metropolitan Property & Casualty will return $3.5 million, Plymouth Rock Assurance and Pilgrim Insurance will collectively return $3.6 million, and USAA will return $2.3 million to policyholders. The insurance companies will also make payments to the state totaling more than $500,000 and adopt conduct reforms. Under the terms of similar settlements the Attorney General entered into in January, Safety Insurance Company is expected to return $7.2 million, Liberty Mutual will return $3.1 million and Quincy Mutual will return $800,000 to affected consumers. The three insurance companies will also make payments to the state totaling $510,000. The Attorney General’s investigation into other insurance companies is ongoing.

The Attorney General’s Office began its investigation into motorcycle rating practices in the fall of 2008 after receiving a complaint from the owners of a 1999 Harley Davidson Road King Classic. The owners alleged that Safety had valued their 1999 Harley Davidson Road King Classic at $20,000 in each year between 2003 and 2008, but had offered the owners less than $11,000 to settle their claim after the motorcycle was stolen. After the owners requested $20,000 in settlement of their claim, Safety tried to refund over $1,500 in premiums to them based on the errant $20,000 value that Safety had used to rate their insurance policy in each year between 2003 and 2008.

Based on this complaint, the Attorney General’s Office became concerned that Safety was violating its rating manual, which required Safety to use current motorcycle book values to calculate the premiums charged to consumers. After determining that Safety had used inflated and un-depreciated motorcycle values to rate coverage for thousands of its policyholders, the Attorney General’s Office expanded its review to other insurance companies. The Attorney General’s investigation found that many auto insurers operating in the Massachusetts marketplace had failed to obtain current book values for motorcycles they insured and were instead using inflated and out of date values to calculate premiums. The Attorney General’s investigation also found that while the alleged overcharges began during the “fix-and-establish” period, when the state capped auto insurance rates, the overcharges continued after the deregulation of the auto insurance market and the introduction of “Managed Competition.”

Liberty Mutual will begin paying refunds in May; the remaining insurers are expected to send checks to consumers in the fall. Projected average refunds to consumers are expected to be about $300; however some consumers will receive thousands of dollars based on several factors, such as the length of their policy and the price of their motorcycle. In order to be eligible for settlement funds, a consumer’s motorcycle must have been overvalued by their insurance company and the consumer must have purchased either collision or comprehensive coverage. Tens of thousands of policies are believed to have been affected.

These cases were handled by Investigations Supervisor Arwen Thoman, Mathematician Burt Feinberg, Economist Bryan Lincoln, and Assistant Attorney General Glenn Kaplan, all of Attorney General Coakley’s Insurance & Financial Services Division. The original consumer complaint was handled by Mediator Rebecca Dutra also of Attorney General Coakley’s Insurance & Financial Services Division.

original article

skip to main |

skip to sidebar

Bill & Annie

Art Hall & Rusty

NUFF SAID.......

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

GIVING BACK

MOUNT SOLEDAD

BIKINI BIKE WASH AT SWEETWATER

FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

hanging out

brothers

GOOD FRIENDS

Good Friends

Hanging Out

Bill & Annie

Art Hall & Rusty

Art Hall & Rusty

NUFF SAID.......

NUFF SAID......

Mount Soledad

BALBOA NAVAL HOSPITAL

RUSTY DANNY

ANNIE KO PHILIP

PHILIP & ANNIE

OUT & ABOUT

OOHRAH...

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

ONCE A MARINE,ALWAYS A MARINE

American Soldier Network GIVING BACK

GIVING BACK

CATHY & BILL

PHILIP & DANNY & BILL

MOUNT SOLEDAD

bills today

EMILIO & PHILIP

WATER & POWER

WATER & POWER

bootride2013

BIKINI BIKE WASH AT SWEETWATER

ILLUSION OPEN HOUSE

FRIENDS

GOOD FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

GOOD FRIENDS

Friends

- http://www.ehlinelaw.com/losangeles-motorcycleaccidentattorneys/

- Scotty westcoast-tbars.com

- Ashby C. Sorensen

- americansoldiernetwork.org

- blogtalkradio.com/hermis-live

- davidlabrava.com

- emiliorivera.com/

- http://kandymankustompaint.com

- http://pipelinept.com/

- http://womenmotorcyclist.com

- http://www.ehlinelaw.com

- https://ammo.com/

- SAN DIEGO CUSTOMS

- www.biggshd.com

- www.bighousecrew.net

- www.bikersinformationguide.com

- www.boltofca.org

- www.boltusa.org

- www.espinozasleather.com

- www.illusionmotorcycles.com

- www.kennedyscollateral.com

- www.kennedyscustomcycles.com

- www.listerinsurance.com

- www.sweetwaterharley.com

Hanging out

hanging out

Good Friends

brothers

GOOD FRIENDS

EMILIO & SCREWDRIVER

GOOD FRIENDS

Danny Trejo & Screwdriver

Good Friends

Navigation

Welcome to Bikers of America, Know Your Rights!

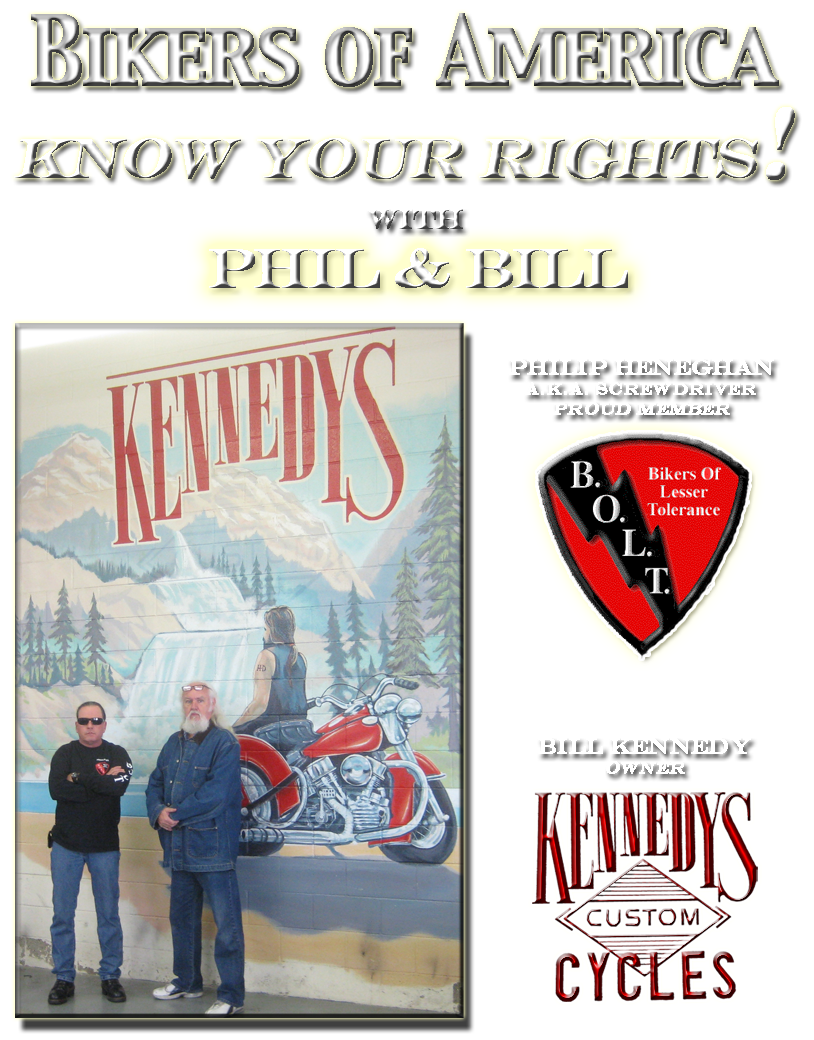

“THE BIKERS OF AMERICA, THE PHIL and BILL SHOW”,

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

Good Times

Hanging Out

Key Words

- about (3)

- contact (1)

- TENNESSEE AND THUNDER ON THE MOUNTAIN (1)

- thinking (1)

- upcoming shows (2)

Blog Archive

-

▼

2010

(4242)

-

▼

April

(425)

- Harassment

- Who doesn’t tell the Motorcycle Helmet Story–the m...

- Latest on Vertical License Plate in Florida

- Motorcycle Training Bill Is Approved By The Senate

- lake-elsinore-police-crack-down-on-motorcycle-safety

- A Complaint about a cop

- ABATE of Florida Elections

- New Arizona immigration law and ID demands

- An Applicable Perspective

- Sask. government revising gang colour ban

- Hells Angels bike blessing

- Early motorcycle season concerns police

- Rogue endorses Frankie Kennedy for President of AB...

- ASMI’s Road Guardian Program creates “Thrash”

- Owner latest arrested after pizzeria brawl

- Motorcyclists challenge seizure of alleged illegal...

- Alleged Angel jailed on gun, drug charges

- Harley-Davidson has brought back some workers to N...

- New Study: Motorcycle Deaths Down Dramatically in ...

- Street brawl points to new outlaw motorcycle gang ...

- Bikers ride to support abused children

- ‘Web of deceit’ deserves stiff penalty: Crown

- Sask. government revising gang colour ban

- Hells Angels clubhouse days numbered?

- Betsy,

- The Gorilla Story or What is wrong with MRO's

- Mongols Patch Case

- Traffic collision deaths drop in state, CHP says

- Thunder Beach motorcycle rally rolls into town

- Bikers gather for motorcycle safety

- Charity ride denied ending at Old Lyme beach

- Tonight on the Biker Lowdown: Geneva & the Extermi...

- If you jump onto Harley, you’ll arrive ‘late to th...

- "E-MAIL BLAST" local 6

- Henderson PD Complaint

- DATE CORRECTION DATE CORRECTION

- BOLT talks about Rights and your abilities

- MMA UPDATE - Lynnfield EPA Bylaw defeated!

- Cops Charged & Things they don't want the public t...

- Russell Doza

- Due Process is a right, RIGHT? Watch out for our B...

- SB 435

- MMA Call to Action - Prevent a federal helmet law!

- Town Hall Freedom Rally

- Motorcyclist deaths drop; sour economy cited

- Bikers of Lesser Tolerance Announces New Chapter i...

- Man Charged With Homicide For Motorcycle Crash(WCC...

- Every day is Earth Day when you ride a motorcycle

- MMA Call to Action - Prevent a federal helmet law!

- False Assumptions About Motorcycle Noise and the A...

- SCORPIONS Added To STURGIS MOTORCYCLE RALLY

- Bridgestone Motorcycles to be showcased as Classic...

- Pagan's defendants plead no contest to conspiracy

- Local Winnipeg Free Press - PRINT EDITION Sentence...

- Motorcyclist deaths drop; sour economy cited

- U.S. Defenders Take Oregon Motorcycle Rights to th...

- Bikers 'wild' about helping others

- Group Raises Awareness About Motorcycle Safety

- Ill Highwaymen member will be tried in absentia

- Legislation targets criminal groups

- Bikers to dedicate wall to fallen comrades

- Harley Davidson 'chop shop' in Damascus

- Motorcycle Training Could Be Mandatory Related Pol...

- mandatory rider ed bill passed

- US Defender Program

- Helmet warning: A lone-officer motorcycle helmet c...

- CA: Police to conduct motorcycle safety enforcemen...

- Kouts biker trial opens next week

- Two facing charges in assault at 22nd Street Disco...

- Hogs, Fat Boys blessed to ride in New London

- Brawl or no brawl? Only bike gangs know the truth

- FOR IMMEDIATE ACTIONMMA Call to Action - Prevent a...

- MMA Legislative Alert-Falmouth Noise Bylaw

- MORE BULLSHIT OUT OF WASH. DC

- Start Planning for International Female Ride Day A...

- Metro Police To Begin Using Gang Injunctions Gang ...

- May is Motorcycle Awareness Month… schedule a ride...

- Londonderry man arrested in shooting Police say by...

- OFF THE WIRE http://www.google.com/hostednews/ap/a...

- And finally some good news

- Rival motorcycle gangs brawl in SE Minn

- Bikes Are Back In The Big Easy!

- LA_Calendar_Motorcycle_Show

- 13 Pagans defendants avoid federal charges via ple...

- LOCAL 6 INFO

- Women in the Wind Women's Ride Day

- Officers Ride for a Good Cause

- Attacks leave Hemet reeling

- Highwaymen defendant suffers heart attack; mistria...

- Man arrested in connection with weekend NH shooting

- Bikers stimulate small-town economies

- Harley-Davidson revs Sturgis Motorcycle Rally

- Gotta love Ted Nugent

- Gang Evidence Resulted in Reversal of Murder Convi...

- Law mandates noise levels, vendors, drinks

- Class Action Lawsuit brought against Census Bureau

- Biker’s Rally for Justice

- “THE BIKERS OF AMERICA,THE PHIL AND BILL SHOW”

- Bikers Against Discrimination (B.A.D.)

- WASHINGTON:Washington Trooper clocks motorcycle at...

-

▼

April

(425)

Bikers of America, Know Your Rights!... Brought to you by Phil and Bill

Philip, a.k.a Screwdriver, is a proud member of Bikers of Lesser Tolerance, and the Left Coast Rep

of B.A.D (Bikers Against Discrimination) along with Bill is a biker rights activist and also a B.A.D Rep, as well, owner of Kennedy's Custom Cycles