OFF THE WIRE

Written by Digits | |

It’s a quandary new and experienced bikers face on an annual basis, insuring your two wheels of happiness correctly, completely and of course, cost-effectively. Online Motorcycle Magazine looks at the Do’s and Don’ts of motorcycle insurance.

Starting to ride a motorcycle isn’t as easy as simply jumping on and riding off. There’s a lot of work to be done before a biker can feel the wind in their face as they ride down that road to nowhere.

Finding the right motorcycle, deciding on which gear to wear and probably the least exciting point on the to-do checklist, getting the best insurance. But what is the best insurance? What’s a fair price and how much is enough coverage?

These seem to be the most common and recurrent questions asked in motorcycle showrooms across the country as well as on forum boards around the internet. And not just by new riders, but also from seasoned bikers who feel they’re paying too much also pose the question just as frequently.

"Rates really vary a lot," says Ben Sheridan, general manager for motorcycle insurance with Progressive Casualty Insurance Co., the top motorcycle insurance underwriter in the U.S. "From one bike to another, they can be five to ten times different."

By way of example, he says a premium of $200 for insuring a small or midsize commuter-type motorcycle can easily balloon to more than $1,000 for a high-horsepower, canyon-racer sport bike.

In this article we’ll cover everything about motorcycle insurance, from what it is to where it can be found. Since the staff of Online Motorcycle Magazine live in the United States, that’s where we’ll focus on, but many of the principles and tips could apply to countries around the world.

What is Insurance?

Insurance is a form of risk management primarily used to hedge against the risk of a contingent loss. Insurance is defined by wikipedia as ‘the equitable transfer of the risk of a potential loss, from one entity to another, in exchange for a premium.’ The first policies date back to the Babylonians in 1750BC for merchant’s who took loans to fund shipments. They would pay the lender an additional sum in exchange for a guarantee to cancel the loan should the shipment be stolen.

In today’s world, motorcycle insurance is required in nearly every state (all but nine require riders to carry motorcycle insurance). At the very least, you'll probably need to purchase liability coverage. Generally, the minimum amount or your motorcycle insurance will be equal to the minimum amount of liability coverage for car insurance in your state. However, if you own property or have a high income, you'll probably want to purchase higher than the minimum limits. While it's more likely that you will get injured, or your bike will be damaged in an accident, your liability coverage also protects you from injuries you cause to a pedestrian.

Aside from being legally required as well as offering financial protection, the proper levels of insurance will ensure that your motorcycle you’ve logged thousands of miles on and become emotionally attached to, gets repaired to its former glory in the sad case of a mishap.

Bikers shouldn’t think that they can ride their way out of an accident either as it appears statistics are against them. Studies conducted by the National Safety Council in the U.S. estimates that a motorcycle accident seriously injuring at least one person occurs once every fourteen seconds. Another study by the National Insurance Crime Bureau Statistics reveals that there is an alarming rise in the theft of motor vehicles especially motorcycles. What is more alarming is that only 20-25% of the stolen bikes are ever recovered.

Motorcycles are small and relatively light, some are compact making it easy for the crime of theft to occur. A fire, explosion or flood is all it takes to destroy your dream machine. Simply put a biker would have to be a fool to even think about skipping motorcycle insurance.

Some states also require Uninsured Motorists/Underinsured Motorists coverage to pay for injuries or damage to your bike in an accident with a driver who doesn't have insurance or not enough to cover your expenses.

And then there are the States that have the confusing no-fault insurance laws.

Virtually every state requiring insurance companies to offer no-fault auto insurance either excludes or allows companies to exclude motorcycles from a no-fault policy.

Although this may not seem fair, when viewed from the insurance companies' perspective, it's understandable. It's also directly related to one of the idiosyncrasies of no-fault insurance. No-fault insurance, known in some jurisdictions as Personal Injury Protection, or PIP, essentially turns traditional liability insurance on its head.

At its most basic, no-fault insures you against losses you may suffer in the event you're in a crash regardless of who's at fault. Traditional liability insurance covers the losses you may inflict on another in a crash for which you're at fault and expects you to recover from the other driver when you're not at fault.

Thus, a 20-year-old with no mortgage, no family to support and a minimum-wage job stands to "lose" much less than a 40-year-old with a mortgage, a couple kids in college and a lifestyle supported by a six-figure income. Thus, the kid will generally pay less for a no-fault policy than the 40-something.

This is precisely the opposite of traditional liability insurance, where the kid is considered the higher risk and more likely to be at fault in a crash and be liable for the significantly greater losses the 40-something will suffer.

But because motorcyclists are more often seriously injured or killed in a crash regardless of who's at fault, insurance companies prefer to write the coverage as traditional liability.

Another tricky thing about motorcycle insurance is that it usually applies ONLY to your own bike. This means that if you are riding somebody else's bike, you are not covered by your own insurance. Every state may have its own rules regarding this. Many youngsters also automatically assume that if they are riding the family bike, they will be automatically covered by the motorcycle insurance.

Categories and confusion

Since we’ve stumbled into types of coverage, it’s a perfect opportunity to review the different categories of the sometimes confusing types of insurance available in the typical motorcycle policy.

Comprehensive coverage. The foundation of any insurance policy protects the motorcycle from any damage that didn’t happen from an accident. Covering everything from damages caused by theft, fire, vandalism, disasters to hitting an animal on the road.

Bodily Injury Liability Insurance. Bodily injury liability is another type of coverage that you are required by law to carry in most states. Legal minimum in many states is as little as $10,000 per person, per accident. Your coverage pays for injury to others when the accident is your fault.

If you are involved in a motorcycle accident and the other driver is at fault, then the other driver's property damage liability coverage pays for your motorcycle damage. Property damage liability insurance is required by law, but the legal minimum amount for this coverage in some states is only $5,000 per accident. So, if a driver with the $5,000 minimum totals out your $15,000 bike, his insurance company will pay you only $5,000. How will you get the other $10,000? If the other driver files for bankruptcy, you end up with nothing.

Underinsured Coverage. If you purchased underinsured property damage coverage, you may be able to collect the other $10,000 to fix your bike. This insurance is used to "fill the gap" between the actual amount of damages and what the other driver's insurance paid, but only if the other driver caused the accident and only if you purchased limits high enough to cover all of the remaining damage. In other words, if the legal minimum requirement in your state is $5,000 for property damage liability, and you drive a $15,000 bike, you should have at least $10,000 limits on you underinsured property damage.

Uninsured motorist coverage is the most important insurance you can buy, picking up where the other driver's insurance runs out. This type of insurance is very important. If you are injured in a motorcycle accident, break you leg, spend a week in the hospital and are off work for six months and experience a great deal of pain and suffering. You need coverage high enough to pay for your damages. The other driver only has a minimum policy of insurance (ie) $15,000. You will be left holding the bag. It is common that the injured persons medical expenses and wage losses are higher than the other persons insurance. Also nothing is left for pain and suffering or permanent disability.

Therefore, you need underinsured motorist coverage to pick up the difference. This type of coverage is strongly recommended because of its importance. It is suggested that you carry a minimum of 100/300 coverage (100 per person/300 per accident) this will also protect your passenger.

In many metropolitan areas the other drivers are uninsured. These uninsured drivers can make up as high as 40% of the drivers on the road! As you know, the motorcycle driver is not at fault in most accidents so there's a high probability of being hit and injured by a driver who has no insurance. The only way you can protect yourself is to purchase uninsured motorist coverage. Uninsured motorist coverage pays for medical expenses, property damage, and pain and suffering (however, there are limitations in no-fault states). We strongly recommend that you purchase this insurance and do not drive without it. Many riders mistakenly believe uninsured motorist coverage pays only for medical bills, and that they do not need it because they carry health insurance. Actually, it pays for medical expenses, as well as loss of earnings, and pain and suffering.

Collision Coverage. Collision coverage will pay for damages to your bike, less your deductible. This coverage applies without regard to fault. Even if the damage is your fault the coverage will apply. You also can use this coverage when you have been hit by another person and they are at fault.

Medical Payments. This coverage pays the cost of necessary medical care you receive as a result of a motorcycle accident and can be used regardless of who is at fault. The coverage often is limited to medical treatment received within the first three years after an accident and is limited to a specific dollar amount. In some states, Medical Payments only applies after other medical insurance is exhausted.

Custom Parts and Equipment (CPE). When Physical Damage Liability coverage is purchased, $1,000 of Custom Parts and Equipment (CPE) coverage is included. Additional CPE coverage can be purchased to cover equipment, up to $30,000 in value. CPE covers equipment, devices, accessories, enhancements and changes, other than those that the manufacturer originally installs, that alter the appearance or performance of the motorcycle or ATV. This includes, but is not limited to:

Any electronic equipment, antennas and other devices used exclusively to send or receive audio, visual or data signals or play back recorded media, other than those that the manufacturer originally installs, that are permanently installed on the motorcycle using bolts or brackets, including slide-out brackets.

Sidecars

Trailers designed to be pulled behind a motorcycle or ATV

Trike conversion kits

Custom paint, custom plating or custom exhaust

Mower blades, plow blades or winches

Safety riding apparel, including helmets. (Coverage is provided in the event of a Collision loss. Theft is not covered.)

Note: You should retain photos of the motorcycle and all receipts for custom parts.

Roadside Assistance. This additional coverage provides towing to the nearest qualified repair facility and necessary labor at the place of disablement when your motorcycle is disabled due to any of the following:

Mechanical or electrical breakdown

Dead battery

Flat tire

Lockout

Insufficient supply of fuel, oil, water or other fluids

Entrapment in snow, mud, water or sand within 100 feet of the roadway

Roadside Assistance is available 24 hours a day, 7 days a week

Before considering this type of coverage check your club memberships or motorcycle loan for Roadside Assistance included as a perk or benefit.

What to take and in which flavor

With the different categories available to cover yourself, the motorcycle, a passenger and any vehicle or person involved in a potential accident, which ones are needed and what will it cost?

Some categories are required to be carried by state law. Additional coverage could be needed if any aftermarket chrome, equipment or pipes have been added after the motorcycle was purchased. Including the ‘extra bits’ in the value of your motorcycle will ensure receiving the correct replacement value if it ever gets stolen or totaled in an accident.

If you’ve followed the advice regularly given to new riders of buying a cheap motorcycle (so it doesn’t matter if it’s dropped a couple of times during the learning period) then getting by with the minimum legally required coverage could certainly help with the overall cost of insurance. However, the policies covering other people, or vehicles involved in a potential accident would be important to consider.

Speaking of cost, insurance premiums are determined from a blend of personal information. By knowing what’s involved in calculating a premium not only helps in deciding what to include in a possible policy, but it’ll also ensure any quotes you’ll get will be accurate and close to the final bill. For example, if the person or website offering a quote hasn’t asked for any of the following information, chances are the final cost could be more than the estimate.

Some of the key factors that affect motorcycle premiums are;

Age. It’s obvious that insurance companies consider older riders more reliable and safer than their younger counterparts. This is ironic considering the media consistently tells the world about baby-boomers buying bikes to recapture their youth only to lose their lives.

But if we’re going on stereotypes, one only has to look as far as the local freeway for potential claims with young sportsbike riders speeding in and out of congested traffic.

Driving record. If your driving record is littered with tickets or accidents, then you should expect to pay for higher rates.

Number of miles driven every week. Nearly every traffic study quotes the number of miles traveled compared to the number of miles driven or ridden as a measurable statistic. Consequently, insurance companies reason that the more miles you ride in a month, the more likely you could have an accident. By using your motorcycle on a daily basis your premiums could be much higher than the weekend warrior.

Where you live and more importantly, where does the motorcycle call home? Riders who live in a big city can expect slightly higher rates compared to those who reside in a rural area, even though it may be exactly the same motorcycle. Similarly, a motorcycle parked in a garage is less likely to be vandalized or stolen than one kept in a communal parking lot and is rewarded with lower insurance costs.

And as we’re on the subject of the two wheeled beasts;

What you ride. The insurance premium will have nearly as much to do about the motorcycle as it will about you. What brand, how large of an engine, how old and probably top of the list, what its worth will all directly relate to how expensive the policy will be. If your ride is larger, newer, racier or expensive, expect for a high premium.

But there are ways to lower your insurance policy, and they’re even encouraged by the insurance industry!

Motorcycle Safety Course. Often given as a selling point by the Motorcycle Safety Foundation and Riders Edge, the accredited courses can earn a discount of up to 15%. Most companies, however, limit the discount to three years after completion of the course, giving the seasoned riders reason to take safety course refresher.

Joining a motorcycle organization. Who would’ve thought a biker would get more than some patches to sew on their leather after joining a nationally recognized club?

This avenue of saving money does need a little homework however, looking into both the organization (who should know which companies will offer a discount) as well as the insurance carriers themselves.

Allstate, for instance, posts the following enticement on its Web site: "You might qualify for [a] discount if you are a member of one of the following motorcycle associations: American Motorcycle Association, BMW Motorcycle Owners of America, Gold Wing Road Riders Association, Gold Wing Touring Association, Harley Owners Group, Motorcycle Safety Foundation [and] Venture Touring Society."

Cold can be good. Our northern riding brothers may not be able to use their motorcycles year-round and some insurance companies recognize that offering a "lay up" policy, which suspends all coverage (except comprehensive) during those cold winter months.

Package plan. As with any type of service, insurance companies love to have all your insurance business and will price it accordingly. Discounts can be realized by having home, auto and even life insurance with one company.

Maintain good credit. Your credit rating may affect what you pay for insurance, so take care of it accordingly. Insurance companies have found that people who don't take risks with their money generally take fewer risks with their life and limbs.

For this reason, insurance companies look at factors like "how well they pay their bills," says Ben Sheridan, general manager for motorcycle insurance with Progressive Casualty Insurance Co. It's called, in the trade, a "financial responsibility score," and those who score well score.

"We give them lower rates," he says, "and dramatically lower." How much lower? In some cases, "by more than 50 percent," Sheridan says.

You can get this information directly from the three major credit-rating agencies (Equifax, Experian, Trans Union). There are also various Web sites that allow you to check your credit rating and provide tips on how to improve your score.

Up Your Deductible! By increasing the deductible, the amount you’re responsible for if found to be at fault for the accident, it can help reduce the price of the premium.

However, check with the finance company if you’re using a loan to purchase the motorcycle as they can sometimes limit how much the deductible can be increased to.

Anti-theft devices. Alarms and immobilizers are being more common on motorcycles, with some of the larger manufacturers offering the devices installed from the showroom floor. Permanently attached anti-theft devices can help reduce an insurance policy.

Where to buy

Between billboards, television and those annoying direct mail flyers, it appears that motorcycle insurance is a growing business. New motorcycle purchases have consistently exceeded the million number mark for the last four years with no sign of slowdown. Since this is the number of actual motorcycles sold, not the cost and it really doesn’t take into account new riders buying used bikes, it’s easy to see why the industry has fallen in love with our preferred method of transportation.

Numerous insurance companies have the ability to give quotes online while local agents prefer to work through the process over the telephone or even in person at your house. Just as with any type of insurance, cost should be measured against customer service. Will it be easy to work with an insurance representative in a call center many states away in the case of a claim?

If the local agent route is taken, how proficient or knowledgeable are they about motorcycles? Which local agent is reliable and will work hard for you in the case of a claim.

Just as with deciding and buying a motorcycle, friends, family, dealerships and even clubs are great resources to utilize. Remember that every bikers situation is different. Aside from all the personal details that may give your riding buddy an inexpensive premium, they may also have bundled other insurance with the recommended insurance company to realize a discount you may not be able to. Also, whether it was intentional or not, they may have omitted some of the coverage you’re looking for, adding to any kind of price difference.

It is a good idea to talk to several agents to determine the best coverage that will provide the most cost-effective protection. Bearing mind though, different insurance companies have varying exclusions to their insurance policies leaving direct comparisons a little tricky.

The most common for motorcycle policies is the passenger exclusion, which means that your insurance company will not pay for injuries to, your passenger under your bodily injury liability coverage if you were at fault. Always ask directly about any other types of exclusions as these could heavily influence comparing quotes.

Once you have a few quotes in hand from local agents, you’ll better prepared to tackle the online world of insurance.

The internet has helped insurance companies increase accessibility and reduce operating costs. Some websites give the customer the flexibility to add or reduce categories and coverage to find a premium to fit their budget.

A few things to remember when using online quotes;

Were all the questions asked to cover the categories detailed earlier that are included in pricing an insurance premium?

Don’t ‘fudge’ or omit less than favorable personal information. Although it may help with a lower online quote, the true cost will be realized when the insurance company verifies all your information.

Online quotes don’t include the various discounts mentioned in this article, to see the benefits of those, a call to the insurance company is needed.

With quotes from both local agents as well as online, ask or check on any mileage allowances, or maximum number of miles ridden. For existing customers this is particularly important to ensure you don’t ride more than what’s allowed and consequently affecting the validity of your policy.

With some states requiring you have proof of insurance before riding the motorcycle off of the lot, its not unusual for dealerships to have local agents who can initiate a policy over the phone. This leaves the possibility of either over-paying or being underinsured.

If financing is involved with the purchase, the dealership may even offer to include the policy in the loan. If you’re on an extremely tight budget this could be considered, but consider that what’s being financed is only one year’s worth of insurance and your loan is likely to be over a few years. So you’ll be paying interest on that insurance policy for years after it’s expired, which isn’t the smartest financial move.

Regardless of which way it’s looked at, buying insurance at the dealership as you’re picking up the new motorcycle isn’t the best way to do things.

And the winner is

It can be hard to take the time of thoroughly investigating and finding the most affordable and complete insurance policy. But on the unfortunate day of an accident, you’ll be thankful for all the hard work.

Before the final decision is made, read over your final choice and make sure you’re happy with all the coverage included in the policy. Are any reductions you’ve made in the various categories realistic. If the deductible has been increased are you able to come up with the amount required if you’ve been found at fault for the accident?

Ben Sheridan tracks trends with Progressive's clients by listening to tapes of telephone calls made to the company's "800" number. From this, he says he's troubled by the fact people buying motorcycle insurance repeatedly under-insure in two areas: uninsured motorist and medical liability coverage for the person or people injured when the crash is your fault.

Uninsured motorist coverage fiscally makes you whole again when the driver who t-boned you didn't have insurance or enough of the right kind of insurance. Given that in some states as many as one of every five drivers is uninsured, this is a no-brainer.

And Sheridan doesn't understand why people with a fairly standard, $100,000/person, $300,000/incident medical liability coverage for their car routinely buy only $25,000 for their bike. "You need the same amount for your bike," he says, because "you're going to be liable for the same amount of expense."

The good news about motorcycle insurance comes from the number of companies getting into the market and offering comprehensive insurance packages which usually include coverage for bodily injury and property damage liability, own-damage and collision, uninsured and underinsured motorists, medical costs, custom parts and equipment and roadside support.

But once you have that insurance policy with your motorcycle’s VIN number proudly mentioned, the fight for cost effective insurance isn’t done. If a monthly payment plan was used to pay for the policy, make sure payments are made on-time and receipts are kept. Insurance companies have the right to cancel a policy due to non-payment and you could find it more expensive to get new insurance if it is.

When the renewal of your policy is a few months away, start reviewing it to not check if you’re riding habits are inline with what you have (such as mileage traveled) but if all the coverage is really needed.

The value of your motorcycle might have changed from aftermarket add-ons, all of which needs to be outlined for the insurance company upon renewal. Also, review the money saving tips given in the article earlier such as additional household policies you may want to include with your motorcycle insurance for any possible package discounts.

Although its not as glamorous as a new set of pipes or eye-catching as chrome, insurance could be considered one of the most important aftermarket addition you'll ever need for your motorcycle.

Interesting to think, if riders took a fraction of the time looking and reviewing insurance coverage they spend looking for the latest, hip motorcycle add-on, more would have better coverage for probably a lot less they're spending currently.

skip to main |

skip to sidebar

Bill & Annie

Art Hall & Rusty

NUFF SAID.......

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

GIVING BACK

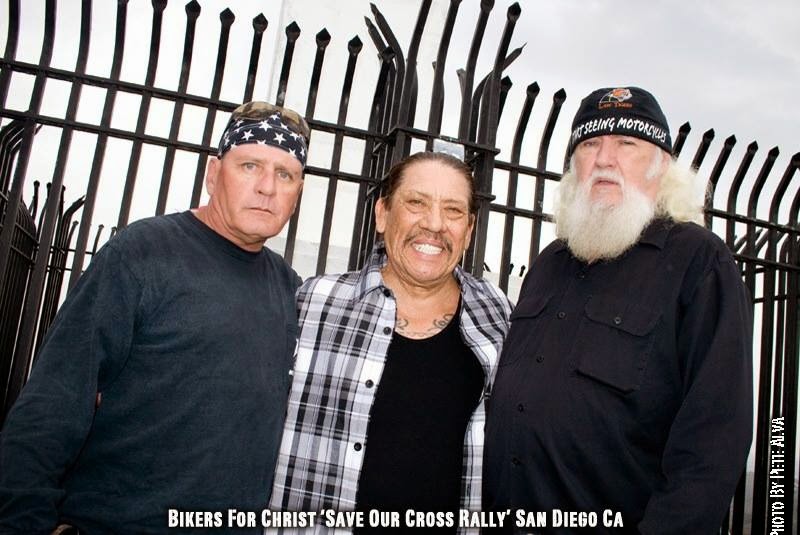

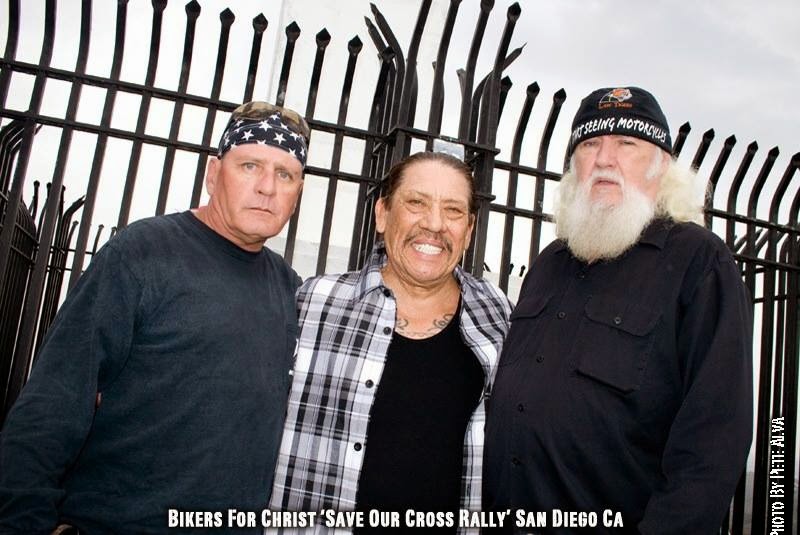

MOUNT SOLEDAD

BIKINI BIKE WASH AT SWEETWATER

FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

hanging out

brothers

GOOD FRIENDS

Good Friends

Hanging Out

Bill & Annie

Art Hall & Rusty

Art Hall & Rusty

NUFF SAID.......

NUFF SAID......

Mount Soledad

BALBOA NAVAL HOSPITAL

RUSTY DANNY

ANNIE KO PHILIP

PHILIP & ANNIE

OUT & ABOUT

OOHRAH...

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

ONCE A MARINE,ALWAYS A MARINE

American Soldier Network GIVING BACK

GIVING BACK

CATHY & BILL

PHILIP & DANNY & BILL

MOUNT SOLEDAD

bills today

EMILIO & PHILIP

WATER & POWER

WATER & POWER

bootride2013

BIKINI BIKE WASH AT SWEETWATER

ILLUSION OPEN HOUSE

FRIENDS

GOOD FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

GOOD FRIENDS

Friends

- http://www.ehlinelaw.com/losangeles-motorcycleaccidentattorneys/

- Scotty westcoast-tbars.com

- Ashby C. Sorensen

- americansoldiernetwork.org

- blogtalkradio.com/hermis-live

- davidlabrava.com

- emiliorivera.com/

- http://kandymankustompaint.com

- http://pipelinept.com/

- http://womenmotorcyclist.com

- http://www.ehlinelaw.com

- https://ammo.com/

- SAN DIEGO CUSTOMS

- www.biggshd.com

- www.bighousecrew.net

- www.bikersinformationguide.com

- www.boltofca.org

- www.boltusa.org

- www.espinozasleather.com

- www.illusionmotorcycles.com

- www.kennedyscollateral.com

- www.kennedyscustomcycles.com

- www.listerinsurance.com

- www.sweetwaterharley.com

Hanging out

hanging out

Good Friends

brothers

GOOD FRIENDS

EMILIO & SCREWDRIVER

GOOD FRIENDS

Danny Trejo & Screwdriver

Good Friends

Navigation

Welcome to Bikers of America, Know Your Rights!

“THE BIKERS OF AMERICA, THE PHIL and BILL SHOW”,

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

Good Times

Hanging Out

Key Words

- about (3)

- contact (1)

- TENNESSEE AND THUNDER ON THE MOUNTAIN (1)

- thinking (1)

- upcoming shows (2)

Blog Archive

-

▼

2013

(2470)

-

▼

August

(167)

- Sons of Anarchy' spoilers: Ending has two opposing...

- Before You Sue ...

- The Sam Cro Radio Show, Exclusive interview with f...

- SAN DIEGO, CA - Police cracking down on motorcycli...

- AUSTRALIA - Treating tattooists like criminals wo...

- ARIZONA - Still no charges filed in Iron Brotherho...

- UTAH - Law enforcement preps for Labor Day

- New Research Supports the Notion That There’s No S...

- USA - With cameras watching, your car isn't your c...

- U.S. Dominates Volume Of Government Requests For F...

- NEW YORK - Appeals Court: Asking For Lawyer Doesn’...

- Protect your privacy from event data recorders

- BABES OF THE DAY

- USA - ACLU raises privacy concerns about police te...

- How to serve a warrant: 1972 versus today, by Lt. ...

- PIC OF THE DAY

- California Begins Confiscating Legally-Purchased Guns

- USA - FISA Court Ruled NSA Program Unconstitutiona...

- Sons of Anarchy Season Six Teaser Trailer Released...

- USA - Substitutionary Justice In A Free Society

- Babe`s of the DAY..... This is 18 and older. Rest...

- Babe`s of the DAY.....

- AUSTRAILA - Police could search without warrant..WTF

- USA - Bikers to counter Muslim march...

- Austraila - Push to deny permits for outlaw motorc...

- CA - Federal Investigation Tip-Off Didn't Obstruct...

- CA - Investigations, Proceedings And SOA

- Boot Ride 2013 with Sons of Anarchy

- USA - The who's who, How I Exposed an Undercove...

- CALIFORNIA - Join the Boot Campaign Motorcycle Clu...

- Attorney General: Drug Sentences Need Reform, Too ...

- USA - Obamacare is coming, and so are the con artists

- Drones find new fans in Middle East and Asia

- CA - George Christie Going To Prison

- BABES OF THE DAY

- USA - Pentagon unveils measures to combat sexual a...

- USA - 'High' taxes

- Seattle police to distribute Doritos at pot rally

- New English Language Word

- See you LABOR DAY WEEK-END Locura Festival!!

- Oregon Governor Signs Medical Cannabis Dispensary ...

- USA - Armed TSA teams now roam in public, conduct ...

- NSA loophole allows warrantless search for US citi...

- Colorado - Whistle-Blowing Retired Marine Puts Hal...

- Taxes, Regulations Drive Americans to Underground ...

- USA - Eric Holder: "widespread incarceration...is ...

- USA - What’s at stake? A ban on your right to sel...

- USA - A secretive U.S. Drug Enforcement Administra...

- USA - DEA has doubled its asset seizures since 200...

- It’s on: California state senate passes ammunition...

- Most Common Motorcycle Accidents (And How to Avoid...

- Illegal Traffic Stop in Oregon

- CA - The marijuana industry's latest 'it product':...

- CA - (Video) OC Deputy Detains Dr. For Filming Ar...

- BABE OF THE DAY

- Here’s How Much You’ll Pay Not To Enroll In Obamacare

- USA - A secretive U.S. Drug Enforcement Administra...

- NEW YORK - Federal Judge Rules Bloomberg's NYC 'St...

- MASS - "POW/MIA Commemorative Chair"

- Iranians Could Be Radicalizing Mexicans; Border Pa...

- NEW YORK - Stop-and-Frisk Practice Violated Rights...

- USA - Here Are 5 God-Given Rights That Democrats W...

- Cato Makes Dick Durbin’s Enemies List

- Pls share.

- NORTH WILDWOOD - Disabled veteran kicked off board...

- All about motorcycle insurance

- Police Who Lie, Part 1: Canadian National Police B...

- WARNING!!!! If you take photos with your cell phone

- New York's stop-and-frisk trial comes to a close w...

- CA - Governor Brown Signs "Bathroom Bill" Into Law

- USA - Stop "Organizing for Action"--Take Your Own ...

- Recently, we learned that the NSA's mass surveilla...

- DISCLAIMER

- USA - Why Have Police In America Turned Into Such ...

- WASHINGTON DC - FBI allowed informants to commit 5...

- All too often, other drivers cause motorcycle acci...

- USA - The Who's Who -

- Anti-gun politicians claim we're headed for a gun ...

- CA - Michael Henry “Delano Mike” Pena

- NYPD Hammered for Targeting Minorities With Stop a...

- Government Should Bear the Burden of Showing Why Y...

- USA - Exploited by Your Tax Dollars...........

- Scientists Say Riding Makes You Smarter — But We K...

- BABE OF THE DAY

- http://www.blogtalkradio.com/bikersofamerica.rss

- Bikers of America, The Phil and Bill Show Online R...

- ROSARITO HARLEY FEST 7 /13/ 2013

- USA - Sunlight is said to be the best of disinfect...

- USA - Type The Wrong Thing Into A Search Engine An...

- U.S. agency admits demand for ethanol-gasoline fue...

- USA - Eat Congress

- PIC OF THE DAY

- NEW MEXICO - There Is Something Happening In Albuq...

- USA - Flyer for “Sobriety Checkpoints” or Other

- Junior Brown "Highway Patrol"

- CA - Should Cops Be Allowed to Profile Bikers?

- Frank Palangi opening for UPROAR FEST at SPAC

- CHICAGO,IL - SEC Says Ex-Marine Defrauded Fellow Vets

- AUSTRALIA - CHIEF MINISTER TO CONSIDER NEW BIKIE BANS

- Missouri - Outlaw motorcycle clubs stake their cla...

-

▼

August

(167)

Bikers of America, Know Your Rights!... Brought to you by Phil and Bill

Philip, a.k.a Screwdriver, is a proud member of Bikers of Lesser Tolerance, and the Left Coast Rep

of B.A.D (Bikers Against Discrimination) along with Bill is a biker rights activist and also a B.A.D Rep, as well, owner of Kennedy's Custom Cycles