OFF THE WIRE

http://www.patriotledger.com/business/x819631226/Five-more-insurers-settle-motorcycle-overcharge-cases Five more insurers settle motorcycle overcharge cases Motorcyclists to be reimbursed for more than $12 million in overcharges By Jon Chesto The Patriot Ledger Posted Oct 13, 2010 @ 03:52 AM

BOSTON — The refunds continue to roll in for motorcycle riders now that Attorney General Martha Coakley’s office has reached settlements with five additional insurance companies to collectively reimburse their customers for more than $12 million in overcharges.

With the latest round of settlements, Coakley and her attorneys have obtained agreements that will lead to the return of nearly $34 million in excess insurance premiums to motorcycle riders in the state. More than 100,000 policies are eligible for refunds under the settlements that have been reached so far, with an average refund size of about $320.

The insurers that settled apparently failed to account for the depreciation of the motorcycles over an extended period of time in setting rates for their customers.

Coakley cites an example of a couple from Lynnfield – the original complainants who tipped Coakley’s office to the issue – who had been charged from 2003 through 2008 as if the couple’s 1999 Harley-Davidson Road King Classic was worth $20,000 each year over that time. However, by 2008, the motorcycle was nine years old and worth less than $12,000.

The latest insurers to settle include Arbella Mutual Insurance Co. of Quincy (with an estimated settlement of $6.3 million), Hanover Insurance of Worcester ($2.5 million), Canton-based OneBeacon ($2.1 million), Florida-based NGM ($645,679) and Dedham-based Norfolk & Dedham ($554,480).

Motorcycle insurers have described the overcharging as an honest mistake.

For example, Arbella spokesman Doug Bailey said the company implemented procedures to correctly rate consumers’ motorcycles as soon as the company learned of the issue in 2009. Bailey said the rating process for automobiles involved an automatic depreciation each year when a policy was renewed. But a similar automatic process wasn’t in place for motorcycles.

The other companies that have settled with Coakley in this investigation include: Plymouth Rock (and its Pilgrim Insurance affiliate), Metropolitan Property & Casualty Insurance, USAA, Liberty Mutual, Quincy Mutual and Safety Insurance.

skip to main |

skip to sidebar

Bill & Annie

Art Hall & Rusty

NUFF SAID.......

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

GIVING BACK

MOUNT SOLEDAD

BIKINI BIKE WASH AT SWEETWATER

FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

hanging out

brothers

GOOD FRIENDS

Good Friends

Hanging Out

Bill & Annie

Art Hall & Rusty

Art Hall & Rusty

NUFF SAID.......

NUFF SAID......

Mount Soledad

BALBOA NAVAL HOSPITAL

RUSTY DANNY

ANNIE KO PHILIP

PHILIP & ANNIE

OUT & ABOUT

OOHRAH...

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

ONCE A MARINE,ALWAYS A MARINE

American Soldier Network GIVING BACK

GIVING BACK

CATHY & BILL

PHILIP & DANNY & BILL

MOUNT SOLEDAD

bills today

EMILIO & PHILIP

WATER & POWER

WATER & POWER

bootride2013

BIKINI BIKE WASH AT SWEETWATER

ILLUSION OPEN HOUSE

FRIENDS

GOOD FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

GOOD FRIENDS

Friends

- http://www.ehlinelaw.com/losangeles-motorcycleaccidentattorneys/

- Scotty westcoast-tbars.com

- Ashby C. Sorensen

- americansoldiernetwork.org

- blogtalkradio.com/hermis-live

- davidlabrava.com

- emiliorivera.com/

- http://kandymankustompaint.com

- http://pipelinept.com/

- http://womenmotorcyclist.com

- http://www.ehlinelaw.com

- https://ammo.com/

- SAN DIEGO CUSTOMS

- www.biggshd.com

- www.bighousecrew.net

- www.bikersinformationguide.com

- www.boltofca.org

- www.boltusa.org

- www.espinozasleather.com

- www.illusionmotorcycles.com

- www.kennedyscollateral.com

- www.kennedyscustomcycles.com

- www.listerinsurance.com

- www.sweetwaterharley.com

Hanging out

hanging out

Good Friends

brothers

GOOD FRIENDS

EMILIO & SCREWDRIVER

GOOD FRIENDS

Danny Trejo & Screwdriver

Good Friends

Navigation

Welcome to Bikers of America, Know Your Rights!

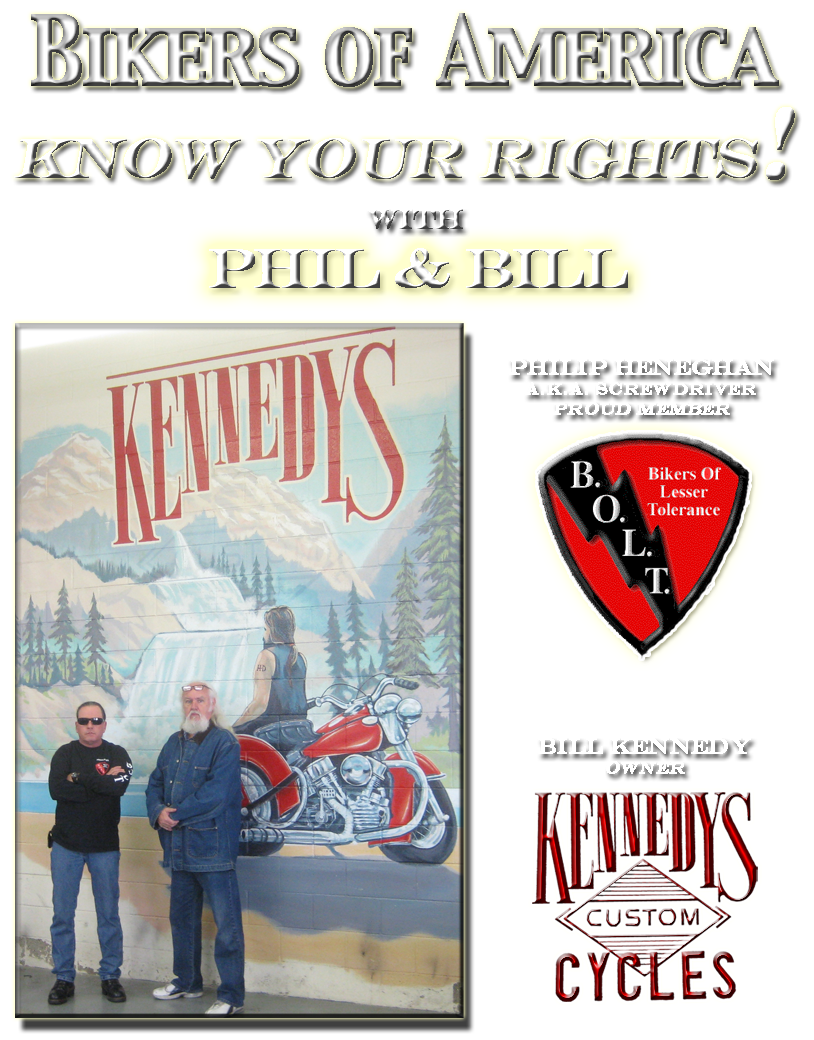

“THE BIKERS OF AMERICA, THE PHIL and BILL SHOW”,

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

Good Times

Hanging Out

Key Words

- about (3)

- contact (1)

- TENNESSEE AND THUNDER ON THE MOUNTAIN (1)

- thinking (1)

- upcoming shows (2)

Blog Archive

-

▼

2010

(4242)

-

▼

October

(447)

- Police continue to harass citizens who record them

- Two Notorious bikie gang members arrested after ba...

- Australia, Iron bar killer jailed for 11 years

- CHARLESTON, W.Va.Two former Pagans sentenced to pr...

- Mob turncoat is sentenced in NYC to time served

- WASHINGTON DC, Motorcycle Group Supports Military ...

- AUSTRALIA, Bikie gang threat can't be ignored

- Hells Angels to sue McQueen

- Johnston City, Ill. Deputies arrest Outlaws member...

- NEW YORK:Bikers in Halloween Costumes Terrorize Up...

- Hello San Diego Volunteers

- Richmond, Va.Jury to begin deliberations in Outlaw...

- Drug accusations fly in court

- Pagans case: School bus driver who helped discard ...

- A BIKER, brawl in the heart of Bondi has left one...

- Poker run benefits Hillsborough Vietnam memorial

- Outlaws gang trial to resume Friday

- Court documents: Santa Clara cop did favors for He...

- OMCG member charged over two shootings – Petersham

- Massachusetts, Settlement gives bikers refunds

- THE top two leaders of bikie gang Notorious will r...

- Two former Pagans sentenced to probation on drug-r...

- Can ATK Cruisers Help Harley-Davidson?

- It’s A Club! Not A Gang!

- November 4th - 7th 10th Annual Rocky Point Rally.

- What is Compromise?

- Barry & Carol Sandberg Murders,PRESS RELEASE

- Oregon,Charitable Biker Event Incites 'Criminal Pr...

- The Hells Angels motorcycle gang sues Alexander Mc...

- Outlaw Country,

- Quote!!!!!!!!!!!!

- VIRGINIA:Update: Outlaws gang trial to resume Friday

- TENNESSEE:Good Samaritan chases down suspected pur...

- RICHMOND, Va. Biker gang member disputes revenge s...

- PORTLAND, Maine, Outlaws motorcycle gang member p...

- Richmond, Va, No verdict yet in Va. biker gang trial

- Tennessee, Man chases two suspects in N. Knox pur...

- ARIZONA:This Week

- Hells Angels set for rumble on the catwalk

- CALIFORNIA:2011 Iron & Lace Custom Motorcycle Pinu...

- Outlaws Motorcycle Gang Member Pleads Guilty

- Stop Complying and Start Defying

- "INCITY TIMES" PUBLISHER IN MY CROSS HAIRS!!!!

- Boston Cop Pietroski, interesting case

- Texas, Bar owners say patrons were not involved in...

- Southern California Biker Information Guide Newsle...

- MEXICO CITY,Every cop in town quits after Mexico a...

- RICHMOND, Va. Biker Gang Trial Wrapping Up In Va.

- Biker gangmember disputes revenge story

- JACKSONVILLE,FLA, Armed Forces Bike Run set

- UPDATE: Defense rests in federal trial of Outlaws ...

- Insurance companies to reimburse overcharged motor...

- Guns! Prostitution! MURDER! This New Ron Klein Spo...

- ABATE web site & Volunteer for Candidates

- AMA:Election Day is Tuesday, Nov. 2 More Info

- I ended up with a list in two commercial breaks of...

- F.Y.I. GOOD READING

- Gang member testifies he was ordered to get even w...

- Informant at Va. biker trial talks of gang 'war'

- High-ranking Comanchero charged over two strike fo...

- Pratt, Kansas, Not your average outlaw biker gang

- Virginia, Bar-B-Q arsonist must pay $25,600

- Richmond, VA, Ex-biker gang member describes alleg...

- LOS ANGELES, CA, Hells Angels v SaksHells Angels ...

- Texas, Bandidos blamed in fight outside isle bar

- Virginia - Richmond, Gang members testify against ...

- How a nerve poison became "food"

- Hells Angels Sue Saks, McQueen Design, Over Trademark

- Australia, No gun found in bikie headquarters raid

- AZ: Police will use digital cameras mounted on the...

- House Rule, H.R 4646

- AG wants to ban drink that hospitalized CWU students

- Australia, Three men bailed over Centrefold Lounge...

- Australia, Another man arrested over Zervas shooting

- Australia, High-ranking Comanchero charged over tw...

- VENTURA, CA, Hells Angel president sentenced

- Virginia, Informant speaks of 'war' with rival gang

- Former Outlaws testify as trial continues

- Canada,Police tight-lipped over reported prison sc...

- Tinley Park biker lives on through the story of hi...

- Australia, Another man charged following investiga...

- Canada, Police tight-lipped over reported prison s...

- READERS SHARE: CHECK THIS OUT

- Trial underway of Milwaukee motorcycle gang leader

- WISCONSIN, Motorcyclists to rev up for Toys for To...

- MANSFIELD, OHIO, Richland County Health Department...

- OHIO: COUNTY HEALTH DEPARTMENT RECEIVES GRANT

- CA, San Jose audit raps cop-car commuting

- October 30, 2010 "RIDE" to Stop Violence Benefit P...

- Redding, CA, Police get grant for traffic safety

- California, Traffic enforcement focus of grant to ...

- More fuel for the fire? Article in the paper

- Wall Street Journal on Obama

- F.Y.I, CA: 7 classes offered for fall at college

- New Zealand, All quiet as bikers roll into town

- Australia, Bikies not all baddies, says magistrate

- F.Y.I. Check This Out, Know how to tell the differ...

- NHTSA and Motorcycle Only Checkpoints

- Robbery Ring Disguised as Drug Raids Nets Convicti...

- Australia, Biker`s wanted over strip club fight

-

▼

October

(447)

Bikers of America, Know Your Rights!... Brought to you by Phil and Bill

Philip, a.k.a Screwdriver, is a proud member of Bikers of Lesser Tolerance, and the Left Coast Rep

of B.A.D (Bikers Against Discrimination) along with Bill is a biker rights activist and also a B.A.D Rep, as well, owner of Kennedy's Custom Cycles