The Massachusetts Motorcycle Association (MMA) is pleased to report information received from the Massachusetts Attorney General’s Office (AGO) indicating that long awaited refunds from USAA and NGM are in the process of finally being mailed to subscribers!

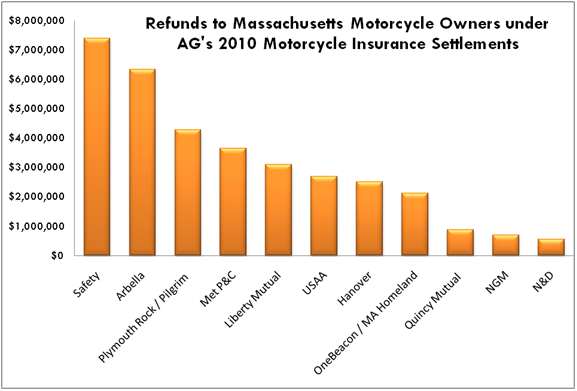

As previously reported, USAA and National Grange Mutual (NGM) had reached agreement with the AGO to refund $2.36M and $645K respectively in premium overcharges to motorcyclists who were insured with these carriers. Thanks to significant diligence on behalf of the riders by the AGO, the refund amounts due from these 2 carriers increased by nearly $400k bringing the total being returned to motorcyclists to date to over $34.2M collectively.

As previously reported, USAA and National Grange Mutual (NGM) had reached agreement with the AGO to refund $2.36M and $645K respectively in premium overcharges to motorcyclists who were insured with these carriers. Thanks to significant diligence on behalf of the riders by the AGO, the refund amounts due from these 2 carriers increased by nearly $400k bringing the total being returned to motorcyclists to date to over $34.2M collectively.

Both USAA and NGM began mailing refund checks last week and are expected to complete mailing today. Updates on the AGO’s website are in the process of being made.

On a related note, there is some confusion circulating concerning how Motorcycles are being valued moving forward. The Governor’s Division of Insurance has allowed carriers to employ a new rating method, first introduced by the Automobile Insurers Bureau (AIB) of Massachusetts, which uses the motorcycle’s cost new (MSRP), and applies age depreciation factors. This new method is reportedly similar to what some carriers do in rating certain commercial vehicles.

After confirming with the AGO, while we are mutually concerned about the confusion that might result from carriers changing their practices, we are also concerned that people might misunderstand that the cost new/MSRP figure on the coverage selection page would indicate that their policy will pay replacement cost (the “new” cost of their bike) if the bike is totaled, when in fact, the policy will only pay for the motorcycle’s actual cash value.

Recently, it’s been reported that Commerce has sent out notices to its agents stating that they were changing motorcycle values to “Cost New”. Commerce is not the first company to introduce this practice, rather the AIB first introduced it in April 2010, and other major carriers have already implemented it, including Safety and Premier.

Again, not all carriers have adopted this practice; and while we don’t expect that they will nor are we encouraging them to do so, it’s more important that they ultimately account for the motorcycle's depreciation in some form.

While all this may seem a confusing, at the end of the day, while carriers may have different methods for valuing motorcycles for rating purposes, ultimately, it’s really all about the price of the policy. In this new era of so-called “managed competition,” consider the carrier’s total service to you as a customer, their total cost, and get quotes from a number of different carriers (and different agents since most agents only represent a few carriers). In today’s internet age, it pays to shop around!

And who knows, if all of us motorcycle riders make a group effort to shop our policies, maybe some insurance companies will actually lower their prices!

For more information, please see http://www.massmotorcycle.org, http://www.mass.gov/ago/motorcycles or contact MyRefund@MassMotorcycle.org

On a related note, there is some confusion circulating concerning how Motorcycles are being valued moving forward. The Governor’s Division of Insurance has allowed carriers to employ a new rating method, first introduced by the Automobile Insurers Bureau (AIB) of Massachusetts, which uses the motorcycle’s cost new (MSRP), and applies age depreciation factors. This new method is reportedly similar to what some carriers do in rating certain commercial vehicles.

After confirming with the AGO, while we are mutually concerned about the confusion that might result from carriers changing their practices, we are also concerned that people might misunderstand that the cost new/MSRP figure on the coverage selection page would indicate that their policy will pay replacement cost (the “new” cost of their bike) if the bike is totaled, when in fact, the policy will only pay for the motorcycle’s actual cash value.

Recently, it’s been reported that Commerce has sent out notices to its agents stating that they were changing motorcycle values to “Cost New”. Commerce is not the first company to introduce this practice, rather the AIB first introduced it in April 2010, and other major carriers have already implemented it, including Safety and Premier.

Again, not all carriers have adopted this practice; and while we don’t expect that they will nor are we encouraging them to do so, it’s more important that they ultimately account for the motorcycle's depreciation in some form.

While all this may seem a confusing, at the end of the day, while carriers may have different methods for valuing motorcycles for rating purposes, ultimately, it’s really all about the price of the policy. In this new era of so-called “managed competition,” consider the carrier’s total service to you as a customer, their total cost, and get quotes from a number of different carriers (and different agents since most agents only represent a few carriers). In today’s internet age, it pays to shop around!

And who knows, if all of us motorcycle riders make a group effort to shop our policies, maybe some insurance companies will actually lower their prices!

For more information, please see http://www.massmotorcycle.org, http://www.mass.gov/ago/motorcycles or contact MyRefund@MassMotorcycle.org

Editor's foot note:

On the heels of the latest refunds comes a rate change for comprehensive and collision that I posted last Thursday. How this change supposedly differs from the way carriers were rating physical damage coverage that they were reprimanded for is that now they will be factoring in a depreciation factor. And just to confuse us all more, not all carriers will be adopting this change, and agents have been informed that this new rate calculation change may.... or may not result in a premium change!

It's just one of those, we have to wait and see!! However, please be assured that I did call the AG's office and was informed that this formula has been accepted by the AIB.

Just when we think we know what we're doing, and how things are done.... they get changed! lol~

Anyone with questions can call me in the office, thanks!

Anyone with questions can call me in the office, thanks!