OFF THE WIRE

Think grandma and grandpa are the most likely to fall for Internet scams? Think again, suggests a study on gullibility released earlier this month.

Younger, less educated, underpaid Americans are the group most likely to fall for schemes of digital criminals peddling fake charities, rogue antivirus software or myriad other cons, the survey indicates. Middle-class earners are less likely to be victims, but folks earning more than $200,000 annually seem to be almost as gullible those living below the poverty line, it found.

Brits and Australians are more skeptical than their American counterparts, says the study, released by security firm PC Tools and survey firm The Ponemon Institute. Only those three nations were studied.

The vulnerable age result might surprise those used to the caricature of older folks who fumble their way through e-mail and Web pages.

"My gut tells me this is really surprising," said Larry Ponemon, who runs The Ponemon Institute. "Just with my own children, they grew up with technology. They are a lot smarter with these things, I thought. For me, it was a counterintuitive result. We found that in the UK and Australia as well."

But Stephen Greenspan, author of “Annals of Gullibility: Why We Get Duped and How to Avoid it,” said the young and uneducated are always the most vulnerable group because they often haven’t fully developed their skepticism sensors.

"As dumb as it is, a lot of people have responded (to an e-mail scam)," he said. "The biggest thing is how likely someone is to see through it."

The study required a lot of self-reporting by victims on their own behavior, so its results should be taken with a grain of salt. Still, Greenspan said many of its findings were consistent with other research he's seen.

The survey found that scams involving a free prize or free antivirus software were the most successful with Americans, while online charity scams were only about half as likely to find victims. It also found that Americans in the Northeast and Southwest were most likely victims, while Midwesterners and residents of the Pacific Northwest were the most skeptical.

"I live in Michigan. People here feel they have horse sense that have may not exist in other parts of the country," Greenspan said.

The study even waded into political territory, finding that Republicans and Democrats were about equally likely to be victims, while members of some "alternative" parties, like the Tea Party or the Green Party, rated better. Independents were found to the most vulnerable.

The most susceptible target victim of all is a woman between 18 and 25, who lives in the Southwest, earns between $25,000 and $50,000 and doesn't hold a high school degree, the study says. The most scam-proof demographic are is males aged 56 to 65 who've earned an advanced degree, live in the Midwest and earn between $150,000 and $200,000.

The study asked participants to rate how likely they were to fall for various scams, and also how likely they felt others in their demographic were to fall victim. Perhaps the most interesting finding in the study is how critical Americans are of other Americans' critical thinking. In every category, Americans thought their compatriots were much more likely to fall for scams than Brits or Australians thought their countrymen to be. Sixty-two percent of Americans, for example, believed other Americans would give a scammer their credit card number in exchange for a get-rich-quick opportunity, compared to just 43 percent of Australians.

"There is a sense in other parts of the world that Americans are naive," said Rich Clooke, a PC Tools spokesman.

The nations also differ radically when asked to define the best internal fraud-fighting tool. Americans seem to think they can outsmart con artists, as they ranked intellect (33 percent) as more important than natural skepticism (16 percent). Australians felt the opposite, ranking skepticism (38 percent) much higher than intellect (16 percent).

The number of survey takers who admitted they might fall for scams was surprisingly high across the board, Ponemon said. Despite constant media attention to the problem, 53 percent of Americans thought they might click and download booby-trapped antivirus software. Nearly 50 percent said they'd surrender personal information to download a free movie, and 55 percent said they'd give a potential scammer their cell phone number for a chance at a prize.

"People knew this was a survey about scams. ... You'd think they'd report themselves as less likely to fall for things," Clooke said. "I really think that complacency, not stupidity, is driving some of these results. Some people may have focused their lives around their computer and Facebook relationships (so) that they lose track of what's real."

Or, perhaps Internet users are finally getting the message that anyone can fall for a scam under the right circumstances.

"We all think we're better lie detectors than we are," said Greenspan, the gullibility expert. said. He would know. He was a victim of Bernie Madoff's Ponzi scheme and lost about 30 percent of his retirement money when he invested in a Madoff feeder fund, persuaded by a friend who was a salesman for the fund.

Greenspan categorizes gullibility under a larger group of what he calls "foolish behaviors," and says four things contribute to someone being foolish at a particular moment: situation, cognition, personality and emotion.

Situation usually involves our natural human tendency to move in packs and do what everyone else seems to be doing. Who wants to be the only person not making money during a booming stock market?

Cognition -- the ability to think through a potential scam -- can abandon potential victims. People of above average intelligence often fail to use that intelligence when conducting everyday business, like deciding whether or not to click on an e-mail.

Personality matters, or course. Some people simply have weaker personalities that that others, and are more susceptible to the power of suggestions.

Meanwhile, emotion is almost always a tool of con artists. They'll urge you to act now because time is limited. They will wear you down with a lengthy sales pitch so you ultimately agree to purchase a time-share that you'd never buy if you were well-rested.

"You can make the point that the brain is (like a) muscle, and when it's tired, it doesn't function as well," Greenspan said. "That's where willpower fails. It takes energy to resist."

One scam-proofing tactic suggested by Greenspan's model: Don't read e-mail late at night, or, at least, don't answer e-mail at night.

Don't miss the next Red Tape:

*Get Red Tape headlines on your Facebook Wall

*Follow Bob on Twitter.

*Get an e-mail newsletter with Red Tape stories (requires Newsvine registration).

skip to main |

skip to sidebar

Bill & Annie

Art Hall & Rusty

NUFF SAID.......

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

GIVING BACK

MOUNT SOLEDAD

BIKINI BIKE WASH AT SWEETWATER

FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

hanging out

brothers

GOOD FRIENDS

Good Friends

Hanging Out

Bill & Annie

Art Hall & Rusty

Art Hall & Rusty

NUFF SAID.......

NUFF SAID......

Mount Soledad

BALBOA NAVAL HOSPITAL

RUSTY DANNY

ANNIE KO PHILIP

PHILIP & ANNIE

OUT & ABOUT

OOHRAH...

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

ONCE A MARINE,ALWAYS A MARINE

American Soldier Network GIVING BACK

GIVING BACK

CATHY & BILL

PHILIP & DANNY & BILL

MOUNT SOLEDAD

bills today

EMILIO & PHILIP

WATER & POWER

WATER & POWER

bootride2013

BIKINI BIKE WASH AT SWEETWATER

ILLUSION OPEN HOUSE

FRIENDS

GOOD FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

GOOD FRIENDS

Friends

- http://www.ehlinelaw.com/losangeles-motorcycleaccidentattorneys/

- Scotty westcoast-tbars.com

- Ashby C. Sorensen

- americansoldiernetwork.org

- blogtalkradio.com/hermis-live

- davidlabrava.com

- emiliorivera.com/

- http://kandymankustompaint.com

- http://pipelinept.com/

- http://womenmotorcyclist.com

- http://www.ehlinelaw.com

- https://ammo.com/

- SAN DIEGO CUSTOMS

- www.biggshd.com

- www.bighousecrew.net

- www.bikersinformationguide.com

- www.boltofca.org

- www.boltusa.org

- www.espinozasleather.com

- www.illusionmotorcycles.com

- www.kennedyscollateral.com

- www.kennedyscustomcycles.com

- www.listerinsurance.com

- www.sweetwaterharley.com

Hanging out

hanging out

Good Friends

brothers

GOOD FRIENDS

EMILIO & SCREWDRIVER

GOOD FRIENDS

Danny Trejo & Screwdriver

Good Friends

Navigation

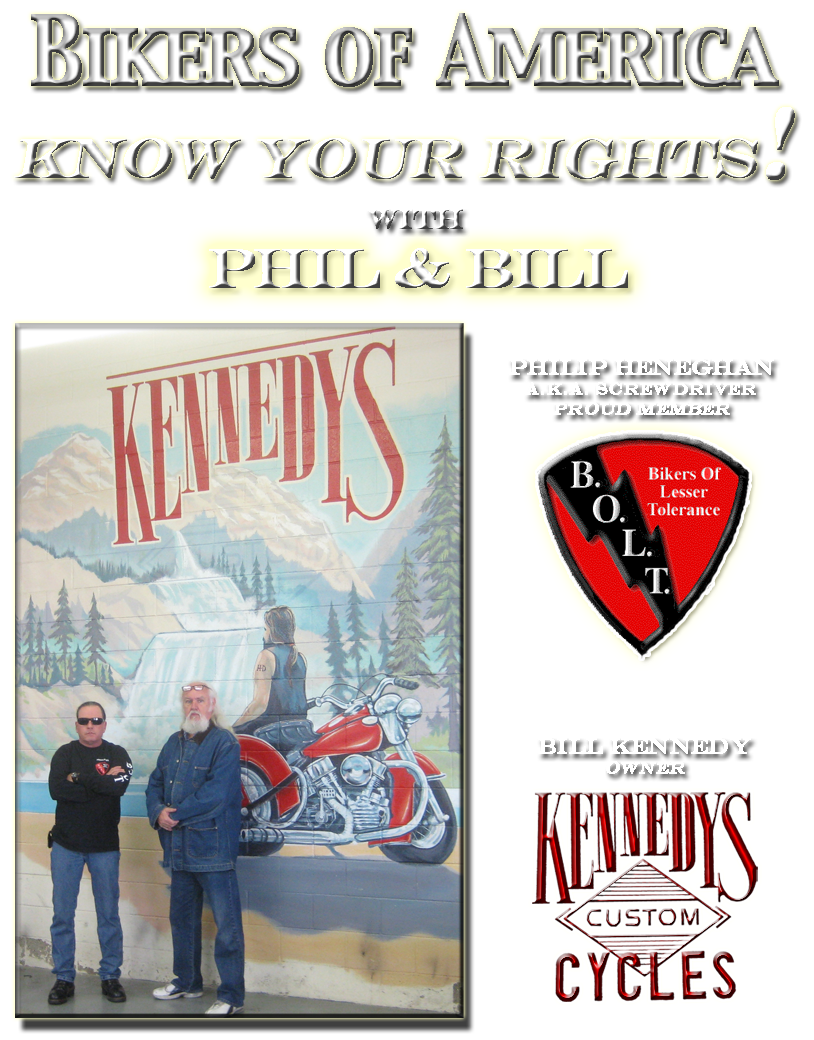

Welcome to Bikers of America, Know Your Rights!

“THE BIKERS OF AMERICA, THE PHIL and BILL SHOW”,

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

Good Times

Hanging Out

Key Words

- about (3)

- contact (1)

- TENNESSEE AND THUNDER ON THE MOUNTAIN (1)

- thinking (1)

- upcoming shows (2)

Blog Archive

-

▼

2012

(4602)

-

▼

January

(463)

- Graffiti Philosophy

- AUSTRALIA - SA to bolster anti-bikie laws within ...

- CANADA - Jeffrey Lynds death investigation continu...

- USA - Healing soldiers, one dog at a time.. Kudos ...

- AUSTRALIA - Editorial: Words are not enough to su...

- AUSTRALIA - Police want Bandidos member Ricky Ste...

- Netherlands - Dutch government gets tough with 'o...

- US - The Caging of America...

- AUSTRALIA - Police say anti-bikie laws are our be...

- AUSTRALIA - OMCG member and associate charged wit...

- Police swarm dealership after tension rises betwee...

- Actually yes, ignorance of the law is an excuse...

- U.S. - The Caging of America....

- ILLINOIS - “HB0930 is a "No Profiling" bill to sto...

- Nude Nuns with Big Guns (Blu-ray)

- AUSTRALIA - Bounty on renegade Comanchero Focarel...

- CHECK THIS OUT!! AZ'S BEING SUED BY OBAMA!!

- AUSTRALIA - First direct arrests in Sydney shooti...

- Canada - SPEARFISH, SD - Spearfish Police Prep For...

- AUSTRALIA - Focarelli silent on SA bikie shooting..

- AUSTRALIA - Chopper tells Troy, 'have my kidney'...

- AUSTRALIA - Comanchero member Giovanni Focarelli ...

- Maine Bill Targeting Gangs Raises Civil Liberties ...

- The Power of the American Biker Culture..Bikers ar...

- NEW HAMPSHIRE - Don’t Stop Recording: Meet James B...

- UNITED STATES - Quick Facts: 26 Signs that the Uni...

- You may have noticed that most Harley-Davidson’s h...

- CALIFORNIA - Map of Bay Area on Facebook offends s...

- CALIFORNIA - EXCLUSIVE: Gang bust gives rare glimp...

- Just Say “NO!!” 4th & 14th Amendments....

- AUSTRALIA - Push to ban bikie after club incidents

- Judiciary committee hears about gangs, including ...

- Photography Is Not Confusing!

- FOX bows to presidential power...

- South Dakota - Hells Angels involved in stabbing c...

- LITCHFIELD - Campbell trial wraps up: Prosecution ...

- Missouri - St. Louis - Thomas Bailey, Maurice Thom...

- Australia - State anxious to introduce 'usable' an...

- CANADA - Alleged biker hitman dies in cell..

- USA - Vets make prison gang list..

- NEVEDA - Biker bar arsonist wants out....

- CALIFORNIA - Police officer shot, killed by fellow...

- St. Louis hosting 1st big parade on Iraq War's end...

- NEW JERSEY - Police to Provide Security at Westbor...

- Welcome to the Road Guardians Compound in Big Bend...

- AUSTRALIA - Man shot in the leg as gunfire erupts...

- CANADA - Sturgis North catches eye of Vernon RCMP

- CANADA - Hells Angels likely to attend huge motor...

- AUSTRALIA - Gun victims won't talk to cops, THEY...

- PETITION TO SUPREME COURT OF ALASKA TO BLOCK NDAA ...

- AUSTRALIA - Finks bikie pleads guilty to drug cha...

- DEPARTMENT OF DEFENSE SLASHES STAFF IN WOUNDED WAR...

- Is this the beginning of mandating "high visibilit...

- This is a fun quiz. Listed below are 10 direct quo...

- Los Angeles Co., CA - Section 8 settlement details

- Sometime secrets make the best fertilizer..........

- Canada - Hells Angels at Okanagan biker rally rais...

- US - Group adds POW-MIA flags at some county facil...

- VIRGINIA - bill advances to ban motorcycles-only c...

- Search: Cops: 4-year-old boy pulls out pot at snac...

- Can a Police Officer Enter a Home Without a Warrant?

- CHARLESTON, W.Va. - Convicted felon running for Li...

- Va. bill would ban motorcycles-only checkpoints. ...

- Made in the USA.............

- Bartow, Fla., to Board of Directors

- WIREMILITARY: Discharged with low disability ratin...

- SAN DIEGO REGION - CHP to target distracted teen ...

- No title

- The U.S. House of Representatives: Pass H.R. 111

- No title

- No title

- How SEAL Team 6 rescued hostages from Somalia

- New Hampshire - Bill would let some felons have guns

- COLORADO - 6 More Alleged Members Of Motorcycle Ga...

- LITCHFIELD - Kevin Campbell trial: Judge denies de...

- Vermont - Police: Gang task force needed........

- Israel's Rosa Parks

- Albany, New York - GoodCop, BadCop

- ILLINOIS - man call 911 fight a cop..

- CALIFORNIA - Fury erupts over bikie 'war' claims

- AUSTRALIA - Mercanti's health 'deteriorated signif...

- Albany, New York - B.A.D. Rises from the Dead!

- CALIFORNIA - PFINGSTEN: ‘100 Bikes for Josiah' tur...

- MASSACHUSETTS - Please review and forward to those...

- U.S. - Need a new cell phone ?

- 5th generation fighter planes !

- Sniffer Dog Case to Hit Supreme Court

- LISTER INSURANCE AT THE BOSTON BIKE SHOW THIS WEEK...

- COLORADO - Judge Orders Defendant to Decrypt Laptop..

- AUSTRALIA - Wounded bikie boss Toby Mitchell out...

- EAST HAVEN, Conn. - FBI arrests 4 officers in trou...

- The New Federal Cellular Phone Bill, effective Jan...

- AUSTRALIA - Government priority to crack down on b...

- OBAMA AT IT AGAIN..

- From Rogue, As I look through the Abate of Florida...

- Interesting story. victim stuck with bills due to ...

- CALIFORNIA - George Christie Trial Postponed

- Supreme Court rules on GPS tracking, but punts on ...

- ILLINOIS - New Law Lets Motorcycles and Bikes Run ...

- Asumati Street Tracker

-

▼

January

(463)

Bikers of America, Know Your Rights!... Brought to you by Phil and Bill

Philip, a.k.a Screwdriver, is a proud member of Bikers of Lesser Tolerance, and the Left Coast Rep

of B.A.D (Bikers Against Discrimination) along with Bill is a biker rights activist and also a B.A.D Rep, as well, owner of Kennedy's Custom Cycles