OFF THE WIRE

Source: thedailyjournal.com

We salute the 80 volunteers who braved last Saturday's bitingly cold winds to bring some holiday warmth to 528 military veterans by laying grave blankets on their markers in Cumberland County Veterans Cemetery in Hopewell.

Fittingly, the decorating began with the grave of William Howard Price, a Marine sergeant and Korean War veteran who was the first person to be buried in the cemetery when it opened in 2000.

The grave blankets, made of donated wood from a lumberyard and trees from a nursery, were made by Cumberland Regional High School students in the Future Farmers of America. The ceremony was organized by the New Jersey Department of the Auxiliary to the Sons of Union Veterans of the Civil War. Without these groups, the event wouldn't have happened, so they deserve our praise.

A local veterans group served as an honor guard, while Civil War re-enactors fired three volleys into the air. Escorted by county sheriff officers and members of the Rolling Thunder motorcycle club, a donated tractor-trailer from Nardelli Bros. Produce transported the blankets from the high school to the cemetery.

"It's my way of praising our grandfather," said Bridgeton resident Chasmine Mosley, who came with family members to decorate the grave of her grandfather, a Vietnam veteran.

With young people such as this, the painful and eternal sacrifices made by veterans on our behalf will never be forgotten.

Saving minutes can save a life

The "golden hour" is defined by the University of Medicine & Dentistry of New Jersey as "the time period of one hour in which the lives of a majority of critically injured trauma patients can be saved if definitive surgical intervention is provided."

Having a medical evacuation helicopter stationed at Millville Airport will help provide those critical extra minutes needed to promptly treat life-threatening injuries (including burns, strokes and heart attacks) and offer the best chance of preventing death.

We credit Cooper University Hospital in Camden, in conjunction with Atlantic Health, for seeing the need here and for taking the chance to launch the aero-medical unit, which will operate a minimum of four teams for 24/7 coverage. Its primary coverage area will be 25 miles surrounding the airport. According to Chief John Redden of the Millville Rescue Squad, EMTs previously could wait as long as 26 minutes for a helicopter. Now the wait would be as little as 12 minutes in Vineland, which could mean the difference between life and death for severely injured patients.

What a difference a little vision and a few minutes can make..

Too many tax dollars lost,

State regulations concerning farmland assessments have to be tightened when millionaires and developers are using the law to do nothing else but slash their property tax bills by 98 percent.

As it stands now, anyone with 5 acres of land who "sells" $500 a year in crops can qualify for the tax breaks. It's so bad and so unregulated that one landowner tried to declare weeds as farm product, a Gannett New Jersey investigation found.

The investigation revealed lax oversight with few inspections for both farmland assessment and its sister program for woodlands. Record-keeping was poor and numerous applications lacked such basic information as an accounting of the goods sold and the signature of the property owner. Why not risk it; even if caught, the penalties would be minimal as compared to other states.

Some tax assessors and farmers fear any changes to the Farmland Assessment Act of 1964 could prompt the sell-off of farm-assessed land in the state, which is not what anyone wants. It's critical New Jersey keeps the garden in the "Garden State."

But it's also a must that the rules be tightened so that the rest of us taxpayers don't have to fill the tax void made by the estimated $82 million a year in lost property taxes through fake farmers.

Governments have to start requiring proof from property owners and verify that the information is correct. State oversight and inspections must be increased, along with penalties. It also would be smart to raise the $500 income threshold. Even considering inflation alone, that $500 set in 1964 would be $3,500 today, as state Secretary of Agriculture Douglas H. Fisher pointed out.

Farms and woodlands have to be preserved in the state. But when a property owner with 34 acres of wooded land in Middletown is paying only $122 in property taxes a year, clearly reforms are needed now.

skip to main |

skip to sidebar

Bill & Annie

Art Hall & Rusty

NUFF SAID.......

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

GIVING BACK

MOUNT SOLEDAD

BIKINI BIKE WASH AT SWEETWATER

FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

hanging out

brothers

GOOD FRIENDS

Good Friends

Hanging Out

Bill & Annie

Art Hall & Rusty

Art Hall & Rusty

NUFF SAID.......

NUFF SAID......

Mount Soledad

BALBOA NAVAL HOSPITAL

RUSTY DANNY

ANNIE KO PHILIP

PHILIP & ANNIE

OUT & ABOUT

OOHRAH...

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

ONCE A MARINE,ALWAYS A MARINE

American Soldier Network GIVING BACK

GIVING BACK

CATHY & BILL

PHILIP & DANNY & BILL

MOUNT SOLEDAD

bills today

EMILIO & PHILIP

WATER & POWER

WATER & POWER

bootride2013

BIKINI BIKE WASH AT SWEETWATER

ILLUSION OPEN HOUSE

FRIENDS

GOOD FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

GOOD FRIENDS

Friends

- http://www.ehlinelaw.com/losangeles-motorcycleaccidentattorneys/

- Scotty westcoast-tbars.com

- Ashby C. Sorensen

- americansoldiernetwork.org

- blogtalkradio.com/hermis-live

- davidlabrava.com

- emiliorivera.com/

- http://kandymankustompaint.com

- http://pipelinept.com/

- http://womenmotorcyclist.com

- http://www.ehlinelaw.com

- https://ammo.com/

- SAN DIEGO CUSTOMS

- www.biggshd.com

- www.bighousecrew.net

- www.bikersinformationguide.com

- www.boltofca.org

- www.boltusa.org

- www.espinozasleather.com

- www.illusionmotorcycles.com

- www.kennedyscollateral.com

- www.kennedyscustomcycles.com

- www.listerinsurance.com

- www.sweetwaterharley.com

Hanging out

hanging out

Good Friends

brothers

GOOD FRIENDS

EMILIO & SCREWDRIVER

GOOD FRIENDS

Danny Trejo & Screwdriver

Good Friends

Navigation

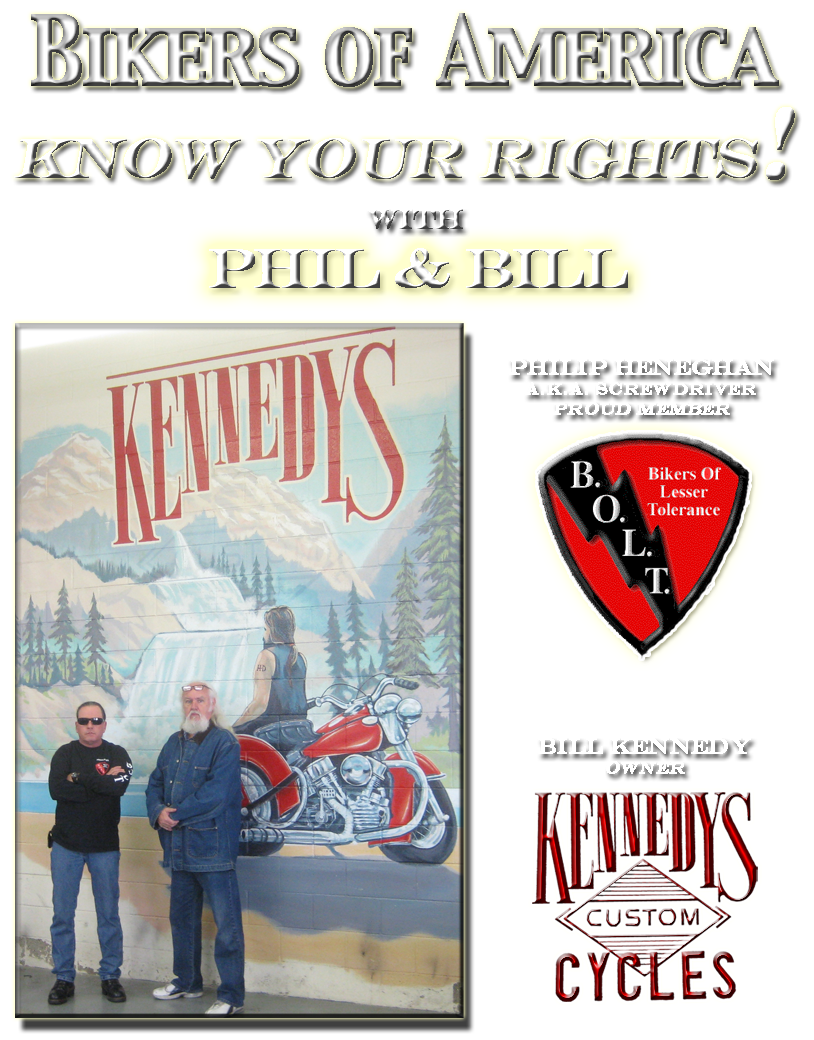

Welcome to Bikers of America, Know Your Rights!

“THE BIKERS OF AMERICA, THE PHIL and BILL SHOW”,

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

Good Times

Hanging Out

Key Words

- about (3)

- contact (1)

- TENNESSEE AND THUNDER ON THE MOUNTAIN (1)

- thinking (1)

- upcoming shows (2)

Blog Archive

-

▼

2010

(4242)

-

▼

December

(595)

- No title

- Canada - TRURO - Startling developments in decade-...

- LOCALS FORGE LAW TO FIGHT MOTORCYCLE THEFT

- DUI - Do you feel your state DUI laws are too stiff?

- Policing the police: No oversight - 2nd Installmen...

- With ‘Sovereign Citizen’ Movement Growing, New SPL...

- UPCOMING EVENTS

- Two indicted on gang-related charges

- FUCK YOU ! Neither 'good' nor 'bad,' fatal police ...

- Fiber Optic Mohawk Helmets. Not For Me. For You?

- CA: Drivers Angered by Freeway Campaign Promoting ...

- JUSTICE DENIED FOR A DISABLED VIETNAM ERA VETERAN ...

- National Police Misconduct NewsFeed Daily Recap 12...

- Canada - Whynott to make court appearance this aft...

- Georgia - Biker babes aid troops, charity

- Scott City, MO - Boot-Heel Harley-Davidson Gives T...

- Australia - Sydney tattoo parlour firebombed

- Australia -Sad loss of a charitable man

- Maine AG: ATF agents justified in shooting biker.....

- California - New state law aims to curb motorcycle...

- Missouri - Patriot Guard bikers proud to block Wes...

- Pro-Gun Argument . . .

- CALIFORNIA - New Motorcycle Law Revs Up Controvers...

- F.Y.I. - FREEDOM OF INFORMATION ACT.......

- Australia - Rival bikie gangs up the ante - Coman...

- National Police Misconduct NewsFeed Daily Recap 12...

- WASHINGTON - DEA transformed into global intellige...

- PROJECT - " NOT GIULTY "

- Happy New Year and Mark Your Calendars for the 201...

- A Premature Alarm Regarding Police Fatality Rates

- FABIAN v. FULMER HELMETS, INC.

- House Checks?

- PROJECT - " NOT GIULTY "

- UNITED STATES - Feds To Require Gun Sale Notificat...

- HARLEY RIM FAILURE!

- Arizona - KINGMAN - 7 alleged Vagos indicted

- The FCC's Threat to Internet Freedom

- 2010 Motorcycle Helmet laws a federal issue again???

- New state laws change rules on drinking, handgun a...

- Scientific Research,Study: Fellatio may significan...

- Back-seat Driver: California toughens motorcycle l...

- ATTIKA7

- New legislation that could potentially affect MC p...

- “THE BIKERS OF AMERICA - THE PHIL AND BILL SHOW”

- California - Santa Clara cop now faces federal cha...

- BOLT of Iraq???

- Last Night's Activism

- Germany - Hells Angels on the rise

- ~ Living Legends ~ Lithograph & Book Signing

- LINKS TO SHARE:

- FABIAN v. FULMER HELMETS, INC.

- U.S. - Monitoring America - "See Something, Say S...

- TENNESSEE: Appeals court orders reconsideration of...

- Pittsburgh officer charged in fatal Sept. crash

- KENTUCKY: This years Ride for Freedom 2011 will be...

- VETERANS BENEFITS ACT OF 2010 SIGNED INTO LAW.

- January 8, 2011 Los Angeles, CA Easyriders Bike Sh...

- More rights stolen!! Now it's the internet!! Thank...

- Washington DC - House to read Constitution - 'We t...

- Fourth Amendment Rights

- Federal helmet recommendation could affect motorcy...

- Motorcycle Helmet laws a federal issue again???

- Off-duty San Diego police officer shoots suspect t...

- New legislation that could potentially affect MC p...

- MEMPHIS, Tenn. (AP) — An appeals court has ruled t...

- Cops' Use of Illegal Steroids a 'Big Problem'

- California Gun Laws: APPEAL FILED IN LAWSUIT CHALL...

- “HERMIS LIVE!”-INTERNET RADIO SHOW-BIKERS: MODERN ...

- OUT OF CONTROL - Cheektowaga, NY - Use of Taser br...

- Winter Motorcycle Tire Tips From Dunlop

- Oklahoma - Police corruption probe to deepen in 2011

- Harley-Davidson, Inc. to report fourth quarter ear...

- UPDATE - Top stories of 2010

- Cyprus - Bikie paymaster faces extradition

- UPDATE - Outlaw bikers convicted in RICO case

- UPDATE - Sex trafficking victims at massage parlor...

- A massage parlor eviction incident in Irvine, CA r...

- HPD Officer Probed in Pill Mill

- Georgetown man says police officer kicked him, bro...

- Pocono, PA - Angels in leather embody spirit of Ch...

- Australia - Rebels bikie citadel up for sale

- California - Former Bell Cop Gets Nine Years in Pr...

- Australia - Christmas party like no other..........

- Australia - Top fugitive nabbed in Cyprus

- National Police Misconduct NewsFeed Daily Recap 12...

- AMA ACTION ALERT - New Omnibus Public Lands Bill i...

- Australia - Bikie sign a hoax: owners

- IMPORTANT NEWS - CNN Breaking News House OKs measu...

- Australia - Gunman 'was taking shots at strip club'

- New rules may result in no fireworks

- INTERNATIONAL NEWS: Jamaica - Police get motorcyc...

- Biker/Santa inspires Club to Hold Toy Drive....

- IOWA: Motorcycle helmets should be required by law

- Australia - Alleged biker bans himself from pubs

- Outlaws Motorcycle Gang Members Found Guilty

- New York - Celebration to recall life of Fran Zygl...

- CHARLESTON, W.Va. - Former prison guard sentenced ...

- CHARLESTON, W.Va - Man who sold cocaine to Pagans ...

- INTERNATIONAL NEWS: Jerusalem - Avi Cohen's injury...

- Illinois - CHICAGO - 'Large Guy' convicted in Chic...

-

▼

December

(595)

Bikers of America, Know Your Rights!... Brought to you by Phil and Bill

Philip, a.k.a Screwdriver, is a proud member of Bikers of Lesser Tolerance, and the Left Coast Rep

of B.A.D (Bikers Against Discrimination) along with Bill is a biker rights activist and also a B.A.D Rep, as well, owner of Kennedy's Custom Cycles