OFF THE WIRE

http://www.latimes.com/business/la-fi-1217-motorcycle-show-20101217,0,5256698.

Motorcycle makers downshift at Long Beach show Only 450 bikes will be on display at the 30th annual International Motorcycle Shows, compared with 725 in 2008, as the industry's struggles continue.

Motorcycles just can't catch a break. While retail sales overall are finally recovering from the worst recession in decades, the motorcycle industry hasn't yet hit bottom.

In decline since late 2008, new motorcycle sales are down 15.3% through the first three quarters of 2010 compared with 2009. Last year, annual sales dropped almost in half to 655,000 after six straight years of 1-million-plus sales.

Nathan Verdugo, 31, of Costa Mesa is an off-road racer who had gotten used to buying a new bike every year. That changed in 2009, when he was laid off from his job with an apparel manufacturer. Now he works for a competitor, making half the money he used to.

"I'm an avid rider, but more recently I'm a poor rider," he said. "The economy's taken its toll. I've gone from making good money to just being happy to be employed somewhere."

He said he'd love to buy a new KTM 350 SX but is instead contenting himself with a new helmet.

This weekend, the nation's motorcycle industry is bringing its latest hopes for recovery to the Long Beach Convention Center.

When the 30th annual International Motorcycle Shows open Friday, 450 motorcycles will be parked on the carpet, including the new BMW K 1600 and Mission R electric race bike. Seven manufacturers will be offering test drives. In 2008, 725 bikes dotted the Long Beach Convention Center floor.

"There has been so much uncertainty with the economy, the consumer is just sitting back and trying to determine, 'Am I safe in my job?'" said Greg Heichelbech, chief executive of Triumph Motorcycles, North America, in Newnan, Ga. Triumph has seen U.S. sales drop to about 7,500 bikes in 2010 from 10,000 in 2008.

After a five-year absence from the shows, Triumph is returning this year to display the largest new product lineup in the company's 109-year history, including the Tiger 800 adventure models. It will also offer test rides.

"Butts on seats is the best way to demonstrate and prove that our product is everything we say it is," he said. "It was time for Triumph to get back into the show to reach a broader swath of motorcycle enthusiasts."

Not every manufacturer feels the same way. Piaggio — which owns the Aprilia, Vespa, Moto Guzzi and Piaggio brands — isn't participating this year, even though it's introducing nine new models to the U.S. market in 2011.

The shows, which travel to 12 cities around the country, are "an excellent platform for launching new models … but for the near term, we're very focused on supporting our dealers," said Paolo Timoni, president and CEO of Piaggio Group Americas in New York.

Piaggio first dropped out of the show last year, as did Austrian dirt bike maker KTM.

What has hurt motorcycle sales so significantly is, of course, the economy, experts say. Consumers haven't had the discretionary income to spend the $13,000 it takes, on average, to buy a new machine, according to the Motorcycle Industry Council, an trade group in Irvine.

The credit crunch has also had a severe effect, because 1 in 3 bikes is at least partially financed.

"Before the economy hit and I lost a job three years ago, I was buying two new motorcycles every year," said Tom Monroe, 52, a motorcyclist who lives in Orange and who would like to buy either a Ducati Hypermotard or Harley-Davidson Nightster but can't afford either one.

Like a lot of bikers, Monroe used his home equity line of credit to buy motorcycles when the housing market was flying high. When his home equity dropped, "that all went away," Monroe said.

Sport bikes, which have a median rider age of 28, and cruisers, with a median rider age of 46, have both seen steep declines. Younger buyers are having difficulty finding credit, industry experts say, and older buyers are simply leery, having seen the values of their retirement plans plummet.

It doesn't help that men have been harder hit than women by the downturn, and that 90% of motorcyclists are male, according to the Motorcycle Industry Council.

Industry leader Harley-Davidson is showing 24 bikes this weekend. Its U.S. sales were off 13.4% through the first nine months of 2010 from the year-ago period; 2009 U.S. sales were down 25.8% from 2008.

Still, the company is No. 1 in market share among women and other minorities, which is where the 107-year-old manufacturer is focusing its sales efforts, along with emerging markets. To help counter U.S. sales declines, Harley-Davidson is adding dealers in Russia, Brazil, India and Jordan.

The problem isn't Harley-Davidson, it's the economy, said industry expert Michael Millman, managing member of Millman Research Associates in New Jersey.

"We should be seeing some improvements in the economy. That should help the sector and help Harley-Davidson," Millman said. "If consumer discretionary spending increases, people are likely to start investing in the names they think of first. Harley-Davidson is a name that's broadly known."

Data from the Motorcycle Industry Council support Millman's point. Several statistics indicate motorcycle ridership is increasing, even if new motorcycle sales have declined. From 2008 to 2009, vehicle miles traveled by motorcyclists increased an estimated 5% and the riding population increased 9%, according to the council.

Motorcycle tire sales have increased 6.6% in 2010 compared with 2009, according to the U.S. Motorcycle Tire Sales Report, indicating people are still riding. They're just riding used bikes.

"We think we're beginning to see the light at the end of the tunnel," said Bob Starr, corporate communications manager for Yamaha Motor Corp. USA in Cypress, which is introducing three new models for 2011, all on view this weekend.

As the year ends, there seems to be "a little bit of renewed interest," he said. "I'm not going to say the industry is going to come back to where it was … but there are many people in this country that are passionate about motorcycling that will sustain the industry and bring about growth, hopefully in the near future."

skip to main |

skip to sidebar

Bill & Annie

Art Hall & Rusty

NUFF SAID.......

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

GIVING BACK

MOUNT SOLEDAD

BIKINI BIKE WASH AT SWEETWATER

FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

hanging out

brothers

GOOD FRIENDS

Good Friends

Hanging Out

Bill & Annie

Art Hall & Rusty

Art Hall & Rusty

NUFF SAID.......

NUFF SAID......

Mount Soledad

BALBOA NAVAL HOSPITAL

RUSTY DANNY

ANNIE KO PHILIP

PHILIP & ANNIE

OUT & ABOUT

OOHRAH...

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

ONCE A MARINE,ALWAYS A MARINE

American Soldier Network GIVING BACK

GIVING BACK

CATHY & BILL

PHILIP & DANNY & BILL

MOUNT SOLEDAD

bills today

EMILIO & PHILIP

WATER & POWER

WATER & POWER

bootride2013

BIKINI BIKE WASH AT SWEETWATER

ILLUSION OPEN HOUSE

FRIENDS

GOOD FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

GOOD FRIENDS

Friends

- http://www.ehlinelaw.com/losangeles-motorcycleaccidentattorneys/

- Scotty westcoast-tbars.com

- Ashby C. Sorensen

- americansoldiernetwork.org

- blogtalkradio.com/hermis-live

- davidlabrava.com

- emiliorivera.com/

- http://kandymankustompaint.com

- http://pipelinept.com/

- http://womenmotorcyclist.com

- http://www.ehlinelaw.com

- https://ammo.com/

- SAN DIEGO CUSTOMS

- www.biggshd.com

- www.bighousecrew.net

- www.bikersinformationguide.com

- www.boltofca.org

- www.boltusa.org

- www.espinozasleather.com

- www.illusionmotorcycles.com

- www.kennedyscollateral.com

- www.kennedyscustomcycles.com

- www.listerinsurance.com

- www.sweetwaterharley.com

Hanging out

hanging out

Good Friends

brothers

GOOD FRIENDS

EMILIO & SCREWDRIVER

GOOD FRIENDS

Danny Trejo & Screwdriver

Good Friends

Navigation

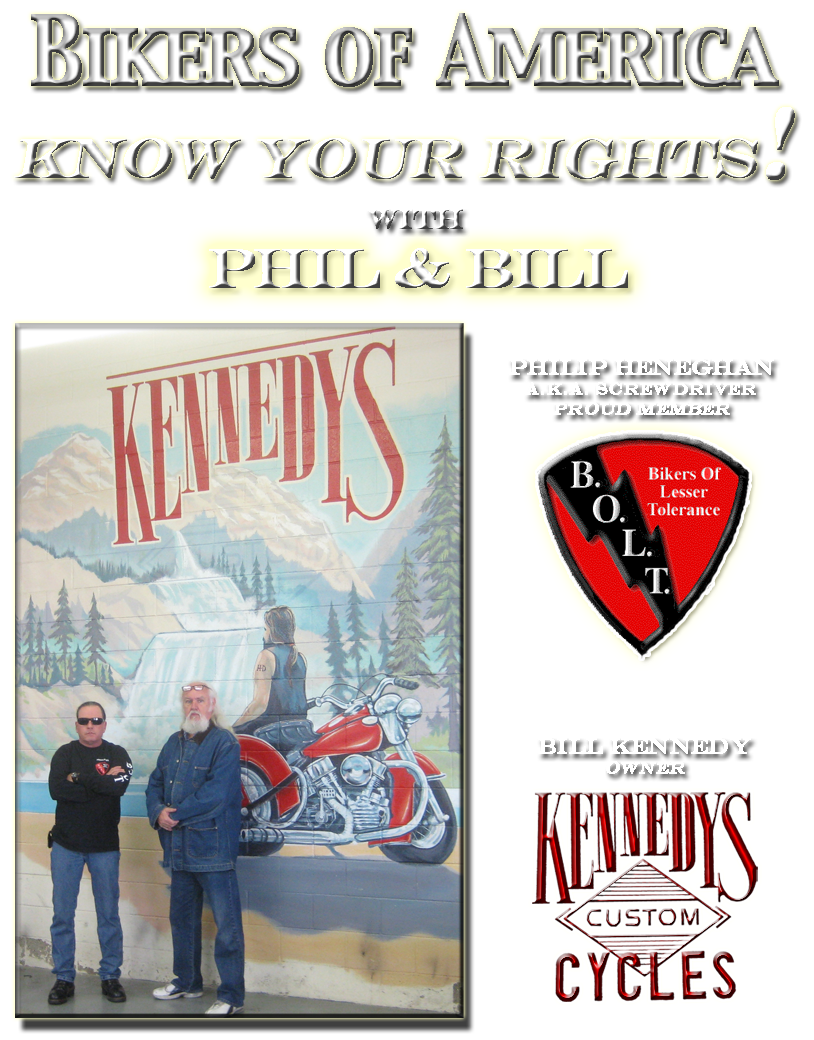

Welcome to Bikers of America, Know Your Rights!

“THE BIKERS OF AMERICA, THE PHIL and BILL SHOW”,

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

Good Times

Hanging Out

Key Words

- about (3)

- contact (1)

- TENNESSEE AND THUNDER ON THE MOUNTAIN (1)

- thinking (1)

- upcoming shows (2)

Blog Archive

-

▼

2010

(4242)

-

▼

December

(595)

- No title

- Canada - TRURO - Startling developments in decade-...

- LOCALS FORGE LAW TO FIGHT MOTORCYCLE THEFT

- DUI - Do you feel your state DUI laws are too stiff?

- Policing the police: No oversight - 2nd Installmen...

- With ‘Sovereign Citizen’ Movement Growing, New SPL...

- UPCOMING EVENTS

- Two indicted on gang-related charges

- FUCK YOU ! Neither 'good' nor 'bad,' fatal police ...

- Fiber Optic Mohawk Helmets. Not For Me. For You?

- CA: Drivers Angered by Freeway Campaign Promoting ...

- JUSTICE DENIED FOR A DISABLED VIETNAM ERA VETERAN ...

- National Police Misconduct NewsFeed Daily Recap 12...

- Canada - Whynott to make court appearance this aft...

- Georgia - Biker babes aid troops, charity

- Scott City, MO - Boot-Heel Harley-Davidson Gives T...

- Australia - Sydney tattoo parlour firebombed

- Australia -Sad loss of a charitable man

- Maine AG: ATF agents justified in shooting biker.....

- California - New state law aims to curb motorcycle...

- Missouri - Patriot Guard bikers proud to block Wes...

- Pro-Gun Argument . . .

- CALIFORNIA - New Motorcycle Law Revs Up Controvers...

- F.Y.I. - FREEDOM OF INFORMATION ACT.......

- Australia - Rival bikie gangs up the ante - Coman...

- National Police Misconduct NewsFeed Daily Recap 12...

- WASHINGTON - DEA transformed into global intellige...

- PROJECT - " NOT GIULTY "

- Happy New Year and Mark Your Calendars for the 201...

- A Premature Alarm Regarding Police Fatality Rates

- FABIAN v. FULMER HELMETS, INC.

- House Checks?

- PROJECT - " NOT GIULTY "

- UNITED STATES - Feds To Require Gun Sale Notificat...

- HARLEY RIM FAILURE!

- Arizona - KINGMAN - 7 alleged Vagos indicted

- The FCC's Threat to Internet Freedom

- 2010 Motorcycle Helmet laws a federal issue again???

- New state laws change rules on drinking, handgun a...

- Scientific Research,Study: Fellatio may significan...

- Back-seat Driver: California toughens motorcycle l...

- ATTIKA7

- New legislation that could potentially affect MC p...

- “THE BIKERS OF AMERICA - THE PHIL AND BILL SHOW”

- California - Santa Clara cop now faces federal cha...

- BOLT of Iraq???

- Last Night's Activism

- Germany - Hells Angels on the rise

- ~ Living Legends ~ Lithograph & Book Signing

- LINKS TO SHARE:

- FABIAN v. FULMER HELMETS, INC.

- U.S. - Monitoring America - "See Something, Say S...

- TENNESSEE: Appeals court orders reconsideration of...

- Pittsburgh officer charged in fatal Sept. crash

- KENTUCKY: This years Ride for Freedom 2011 will be...

- VETERANS BENEFITS ACT OF 2010 SIGNED INTO LAW.

- January 8, 2011 Los Angeles, CA Easyriders Bike Sh...

- More rights stolen!! Now it's the internet!! Thank...

- Washington DC - House to read Constitution - 'We t...

- Fourth Amendment Rights

- Federal helmet recommendation could affect motorcy...

- Motorcycle Helmet laws a federal issue again???

- Off-duty San Diego police officer shoots suspect t...

- New legislation that could potentially affect MC p...

- MEMPHIS, Tenn. (AP) — An appeals court has ruled t...

- Cops' Use of Illegal Steroids a 'Big Problem'

- California Gun Laws: APPEAL FILED IN LAWSUIT CHALL...

- “HERMIS LIVE!”-INTERNET RADIO SHOW-BIKERS: MODERN ...

- OUT OF CONTROL - Cheektowaga, NY - Use of Taser br...

- Winter Motorcycle Tire Tips From Dunlop

- Oklahoma - Police corruption probe to deepen in 2011

- Harley-Davidson, Inc. to report fourth quarter ear...

- UPDATE - Top stories of 2010

- Cyprus - Bikie paymaster faces extradition

- UPDATE - Outlaw bikers convicted in RICO case

- UPDATE - Sex trafficking victims at massage parlor...

- A massage parlor eviction incident in Irvine, CA r...

- HPD Officer Probed in Pill Mill

- Georgetown man says police officer kicked him, bro...

- Pocono, PA - Angels in leather embody spirit of Ch...

- Australia - Rebels bikie citadel up for sale

- California - Former Bell Cop Gets Nine Years in Pr...

- Australia - Christmas party like no other..........

- Australia - Top fugitive nabbed in Cyprus

- National Police Misconduct NewsFeed Daily Recap 12...

- AMA ACTION ALERT - New Omnibus Public Lands Bill i...

- Australia - Bikie sign a hoax: owners

- IMPORTANT NEWS - CNN Breaking News House OKs measu...

- Australia - Gunman 'was taking shots at strip club'

- New rules may result in no fireworks

- INTERNATIONAL NEWS: Jamaica - Police get motorcyc...

- Biker/Santa inspires Club to Hold Toy Drive....

- IOWA: Motorcycle helmets should be required by law

- Australia - Alleged biker bans himself from pubs

- Outlaws Motorcycle Gang Members Found Guilty

- New York - Celebration to recall life of Fran Zygl...

- CHARLESTON, W.Va. - Former prison guard sentenced ...

- CHARLESTON, W.Va - Man who sold cocaine to Pagans ...

- INTERNATIONAL NEWS: Jerusalem - Avi Cohen's injury...

- Illinois - CHICAGO - 'Large Guy' convicted in Chic...

-

▼

December

(595)

Bikers of America, Know Your Rights!... Brought to you by Phil and Bill

Philip, a.k.a Screwdriver, is a proud member of Bikers of Lesser Tolerance, and the Left Coast Rep

of B.A.D (Bikers Against Discrimination) along with Bill is a biker rights activist and also a B.A.D Rep, as well, owner of Kennedy's Custom Cycles