Off the Wire

News Harley-Davidson Inc. shares roared and shot forward like one of the company’s famed motorcycles last week when the company reported that first-quarter profits hadn’t fallen as much as expected.

Whenever a big brand-name stock makes headlines with a jump, and looks like it is poised for a solid future, average investors start getting interested. But in a case like Harley-Davidson, the news that popped the stock also took a lot of potential gains off the board, changing the value proposition.

“People who see the news and want to buy Harley-Davidson now are late to the party,” said Brent Wilsey of Wilsey Asset Management in San Diego. “This is a case where maybe you don’t want to make too much of an earnings surprise. Yes, they had some good news . . . but the news here is not all good.”

Harley-Davidson, of course, is the world’s largest manufacturer of heavyweight motorcycles, controlling roughly half of the domestic sales and one-third of the global market. The company has tremendous brand loyalty, and is known as a favorite of investment legend Warren Buffett.

Plenty of investors will follow Buffett into almost any stock, but they should put the brakes on Harley, where Buffett gave the company a $300 million lifeline 14 months ago. The motorcycle maker is locked into paying Buffett’s Berkshire Hathaway an annual interest rate of 15 percent per year. A buyer of Harley stock isn’t getting that kind of sweet deal.

Harley needed the buyout because the company’s finance arm collapsed during the credit crisis of late 2008. When the market bottomed out, Harley stock turned a corner and started to accelerate. Not surprisingly, the valuations were good.

A year later, and the company’s earnings surprise pushes the shares up by about 10 percent. That means the price has doubled in a year. For average investors, looking at a brand-name stock they plan to buy and hold, the purchase point is more important than many investors give it credit for. Plenty of buy-and-holders believe that a week or two worth of price action is no big deal when considering a stock they plan to own for three or more years.

“Price point is always important,” said Mark Coffelt, manager of the Empiric Core Equity Fund. “Even over a three-year holding period, a 10 percent difference implies a 3 percent per year difference, which is the difference between average and great.”

At this price point, Harley looks worse than average.

The company cut its dividend late in 2009, and didn’t add so much as a penny back during the market’s rebound. While first-quarter profits didn’t fall as much as Wall Street expected, year-over-year sales and earnings were off sharply. It’s no surprise, given the Buffett deal, that total debt is climbing, and that the debt-to-equity ratio now stands at 336 percent, a number that should spook the typical buy-and-hold investor.

Harley may be a cult brand, with incredible user loyalty, but heavy bikes are still a niche market, and one that isn’t likely to grow much until economic recovery is far more robust.

original article

skip to main |

skip to sidebar

Bill & Annie

Art Hall & Rusty

NUFF SAID.......

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

GIVING BACK

MOUNT SOLEDAD

BIKINI BIKE WASH AT SWEETWATER

FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

hanging out

brothers

GOOD FRIENDS

Good Friends

Hanging Out

Bill & Annie

Art Hall & Rusty

Art Hall & Rusty

NUFF SAID.......

NUFF SAID......

Mount Soledad

BALBOA NAVAL HOSPITAL

RUSTY DANNY

ANNIE KO PHILIP

PHILIP & ANNIE

OUT & ABOUT

OOHRAH...

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

ONCE A MARINE,ALWAYS A MARINE

American Soldier Network GIVING BACK

GIVING BACK

CATHY & BILL

PHILIP & DANNY & BILL

MOUNT SOLEDAD

bills today

EMILIO & PHILIP

WATER & POWER

WATER & POWER

bootride2013

BIKINI BIKE WASH AT SWEETWATER

ILLUSION OPEN HOUSE

FRIENDS

GOOD FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

GOOD FRIENDS

Friends

- http://www.ehlinelaw.com/losangeles-motorcycleaccidentattorneys/

- Scotty westcoast-tbars.com

- Ashby C. Sorensen

- americansoldiernetwork.org

- blogtalkradio.com/hermis-live

- davidlabrava.com

- emiliorivera.com/

- http://kandymankustompaint.com

- http://pipelinept.com/

- http://womenmotorcyclist.com

- http://www.ehlinelaw.com

- https://ammo.com/

- SAN DIEGO CUSTOMS

- www.biggshd.com

- www.bighousecrew.net

- www.bikersinformationguide.com

- www.boltofca.org

- www.boltusa.org

- www.espinozasleather.com

- www.illusionmotorcycles.com

- www.kennedyscollateral.com

- www.kennedyscustomcycles.com

- www.listerinsurance.com

- www.sweetwaterharley.com

Hanging out

hanging out

Good Friends

brothers

GOOD FRIENDS

EMILIO & SCREWDRIVER

GOOD FRIENDS

Danny Trejo & Screwdriver

Good Friends

Navigation

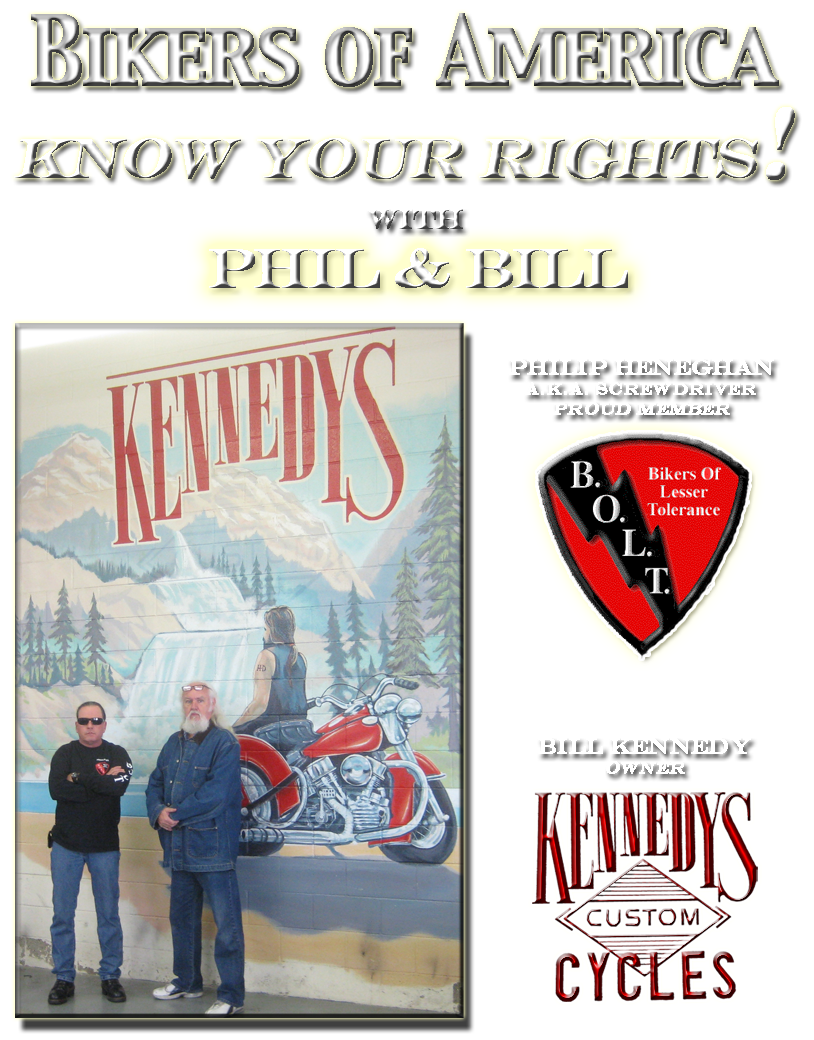

Welcome to Bikers of America, Know Your Rights!

“THE BIKERS OF AMERICA, THE PHIL and BILL SHOW”,

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

Good Times

Hanging Out

Key Words

- about (3)

- contact (1)

- TENNESSEE AND THUNDER ON THE MOUNTAIN (1)

- thinking (1)

- upcoming shows (2)

Blog Archive

-

▼

2010

(4242)

-

▼

April

(425)

- Harassment

- Who doesn’t tell the Motorcycle Helmet Story–the m...

- Latest on Vertical License Plate in Florida

- Motorcycle Training Bill Is Approved By The Senate

- lake-elsinore-police-crack-down-on-motorcycle-safety

- A Complaint about a cop

- ABATE of Florida Elections

- New Arizona immigration law and ID demands

- An Applicable Perspective

- Sask. government revising gang colour ban

- Hells Angels bike blessing

- Early motorcycle season concerns police

- Rogue endorses Frankie Kennedy for President of AB...

- ASMI’s Road Guardian Program creates “Thrash”

- Owner latest arrested after pizzeria brawl

- Motorcyclists challenge seizure of alleged illegal...

- Alleged Angel jailed on gun, drug charges

- Harley-Davidson has brought back some workers to N...

- New Study: Motorcycle Deaths Down Dramatically in ...

- Street brawl points to new outlaw motorcycle gang ...

- Bikers ride to support abused children

- ‘Web of deceit’ deserves stiff penalty: Crown

- Sask. government revising gang colour ban

- Hells Angels clubhouse days numbered?

- Betsy,

- The Gorilla Story or What is wrong with MRO's

- Mongols Patch Case

- Traffic collision deaths drop in state, CHP says

- Thunder Beach motorcycle rally rolls into town

- Bikers gather for motorcycle safety

- Charity ride denied ending at Old Lyme beach

- Tonight on the Biker Lowdown: Geneva & the Extermi...

- If you jump onto Harley, you’ll arrive ‘late to th...

- "E-MAIL BLAST" local 6

- Henderson PD Complaint

- DATE CORRECTION DATE CORRECTION

- BOLT talks about Rights and your abilities

- MMA UPDATE - Lynnfield EPA Bylaw defeated!

- Cops Charged & Things they don't want the public t...

- Russell Doza

- Due Process is a right, RIGHT? Watch out for our B...

- SB 435

- MMA Call to Action - Prevent a federal helmet law!

- Town Hall Freedom Rally

- Motorcyclist deaths drop; sour economy cited

- Bikers of Lesser Tolerance Announces New Chapter i...

- Man Charged With Homicide For Motorcycle Crash(WCC...

- Every day is Earth Day when you ride a motorcycle

- MMA Call to Action - Prevent a federal helmet law!

- False Assumptions About Motorcycle Noise and the A...

- SCORPIONS Added To STURGIS MOTORCYCLE RALLY

- Bridgestone Motorcycles to be showcased as Classic...

- Pagan's defendants plead no contest to conspiracy

- Local Winnipeg Free Press - PRINT EDITION Sentence...

- Motorcyclist deaths drop; sour economy cited

- U.S. Defenders Take Oregon Motorcycle Rights to th...

- Bikers 'wild' about helping others

- Group Raises Awareness About Motorcycle Safety

- Ill Highwaymen member will be tried in absentia

- Legislation targets criminal groups

- Bikers to dedicate wall to fallen comrades

- Harley Davidson 'chop shop' in Damascus

- Motorcycle Training Could Be Mandatory Related Pol...

- mandatory rider ed bill passed

- US Defender Program

- Helmet warning: A lone-officer motorcycle helmet c...

- CA: Police to conduct motorcycle safety enforcemen...

- Kouts biker trial opens next week

- Two facing charges in assault at 22nd Street Disco...

- Hogs, Fat Boys blessed to ride in New London

- Brawl or no brawl? Only bike gangs know the truth

- FOR IMMEDIATE ACTIONMMA Call to Action - Prevent a...

- MMA Legislative Alert-Falmouth Noise Bylaw

- MORE BULLSHIT OUT OF WASH. DC

- Start Planning for International Female Ride Day A...

- Metro Police To Begin Using Gang Injunctions Gang ...

- May is Motorcycle Awareness Month… schedule a ride...

- Londonderry man arrested in shooting Police say by...

- OFF THE WIRE http://www.google.com/hostednews/ap/a...

- And finally some good news

- Rival motorcycle gangs brawl in SE Minn

- Bikes Are Back In The Big Easy!

- LA_Calendar_Motorcycle_Show

- 13 Pagans defendants avoid federal charges via ple...

- LOCAL 6 INFO

- Women in the Wind Women's Ride Day

- Officers Ride for a Good Cause

- Attacks leave Hemet reeling

- Highwaymen defendant suffers heart attack; mistria...

- Man arrested in connection with weekend NH shooting

- Bikers stimulate small-town economies

- Harley-Davidson revs Sturgis Motorcycle Rally

- Gotta love Ted Nugent

- Gang Evidence Resulted in Reversal of Murder Convi...

- Law mandates noise levels, vendors, drinks

- Class Action Lawsuit brought against Census Bureau

- Biker’s Rally for Justice

- “THE BIKERS OF AMERICA,THE PHIL AND BILL SHOW”

- Bikers Against Discrimination (B.A.D.)

- WASHINGTON:Washington Trooper clocks motorcycle at...

-

▼

April

(425)

Bikers of America, Know Your Rights!... Brought to you by Phil and Bill

Philip, a.k.a Screwdriver, is a proud member of Bikers of Lesser Tolerance, and the Left Coast Rep

of B.A.D (Bikers Against Discrimination) along with Bill is a biker rights activist and also a B.A.D Rep, as well, owner of Kennedy's Custom Cycles