OFF THE WIRE

Don't forget to claim federal tax deduction if you bought a new on-highway motorcycle in 2009

March 11, 2010 -PICKERINGTON, Ohio -- The American Motorcyclist Association (AMA) is reminding riders that they may be eligible for a federal tax deduction on their 2009 taxes if they bought a new motorcycle last year.

The American Recovery and Reinvestment Act -- a landmark $787 billion economic stimulus package that President Barack Obama signed into law in February 2009 -- provides a deduction for state and local sales and excise taxes paid on the purchase of qualified new vehicles from Feb. 17 through Dec. 31, 2009. Qualified new vehicles include street and dual-sport motorcycles, scooters, mopeds, cars, light trucks and motor homes.

"At first, Congress was not going to include motorcycles in this bill, but the AMA and the association's members, along with Harley-Davidson and others, persuaded our elected representatives to go back to the drawing board and fix that oversight," said AMA Vice President for Government Relations Ed Moreland. "Congress responded, and now motorcyclists who purchased a new bike last year can enjoy the same tax savings as those who opted for four-wheeled transportation."

Eligible vehicles must have a gross vehicle weight rating (GVWR) of 8,500 pounds or less, and cost less than $49,500. Individuals can take the full deduction if they make less than $125,000, or $250,000 for joint filers. The deduction is phased out for taxpayers with income between $125,000 and $135,000 ($250,000 to $260,000 for a joint return). Individuals don't have to itemize to claim the deduction.

To illustrate the impact of the tax deduction, consider the case of a new motorcycle purchase of $10,500. For a 7.5 percent sales tax rate, the tax would be $787.50. The purchaser takes this deduction on the federal income tax form, reducing their taxable income by $787.50. Sales and excise taxes vary by state, so the actual savings will depend on the taxpayer's state and tax rate.

To read the Internal Revenue Service "Questions and Answers" about the deduction, go to IRS.gov or www.irs.gov/newsroom/article/0,,id=211310,00.html.

Contact: James Holter

Phone: (614) 856-1900, ext. 1280

E-mail: jholter@ama-cycle.org

skip to main |

skip to sidebar

Bill & Annie

Art Hall & Rusty

NUFF SAID.......

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

GIVING BACK

MOUNT SOLEDAD

BIKINI BIKE WASH AT SWEETWATER

FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

hanging out

brothers

GOOD FRIENDS

Good Friends

Hanging Out

Bill & Annie

Art Hall & Rusty

Art Hall & Rusty

NUFF SAID.......

NUFF SAID......

Mount Soledad

BALBOA NAVAL HOSPITAL

RUSTY DANNY

ANNIE KO PHILIP

PHILIP & ANNIE

OUT & ABOUT

OOHRAH...

OOHRAH

ONCE A MARINE,ALWAYS A MARINE

ONCE A MARINE,ALWAYS A MARINE

American Soldier Network GIVING BACK

GIVING BACK

CATHY & BILL

PHILIP & DANNY & BILL

MOUNT SOLEDAD

bills today

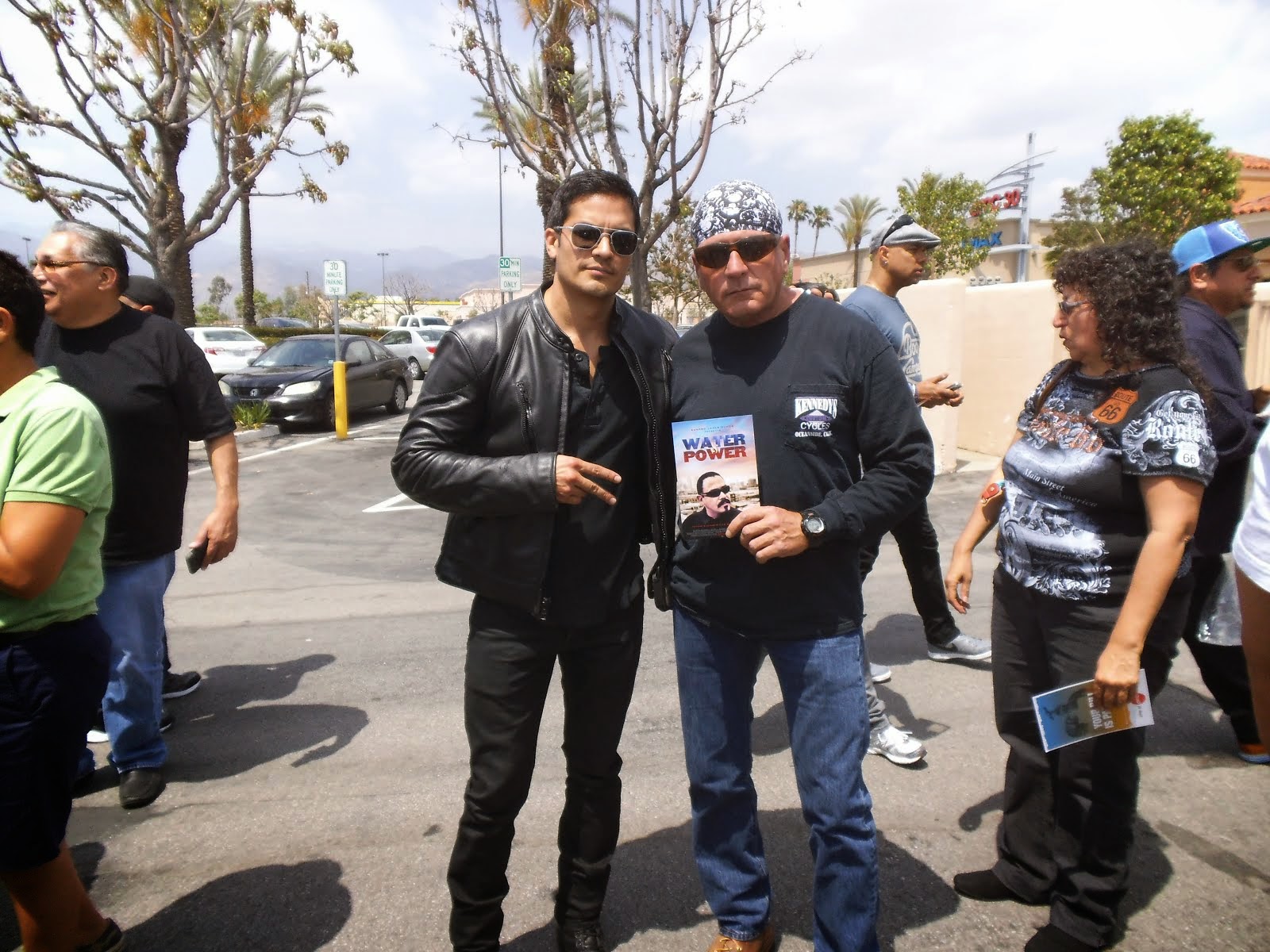

EMILIO & PHILIP

WATER & POWER

WATER & POWER

bootride2013

BIKINI BIKE WASH AT SWEETWATER

ILLUSION OPEN HOUSE

FRIENDS

GOOD FRIENDS

BILL,WILLIE G, PHILIP

GOOD FRIENDS

GOOD FRIENDS

Friends

- http://www.ehlinelaw.com/losangeles-motorcycleaccidentattorneys/

- Scotty westcoast-tbars.com

- Ashby C. Sorensen

- americansoldiernetwork.org

- blogtalkradio.com/hermis-live

- davidlabrava.com

- emiliorivera.com/

- http://kandymankustompaint.com

- http://pipelinept.com/

- http://womenmotorcyclist.com

- http://www.ehlinelaw.com

- https://ammo.com/

- SAN DIEGO CUSTOMS

- www.biggshd.com

- www.bighousecrew.net

- www.bikersinformationguide.com

- www.boltofca.org

- www.boltusa.org

- www.espinozasleather.com

- www.illusionmotorcycles.com

- www.kennedyscollateral.com

- www.kennedyscustomcycles.com

- www.listerinsurance.com

- www.sweetwaterharley.com

Hanging out

hanging out

Good Friends

brothers

GOOD FRIENDS

EMILIO & SCREWDRIVER

GOOD FRIENDS

Danny Trejo & Screwdriver

Good Friends

Navigation

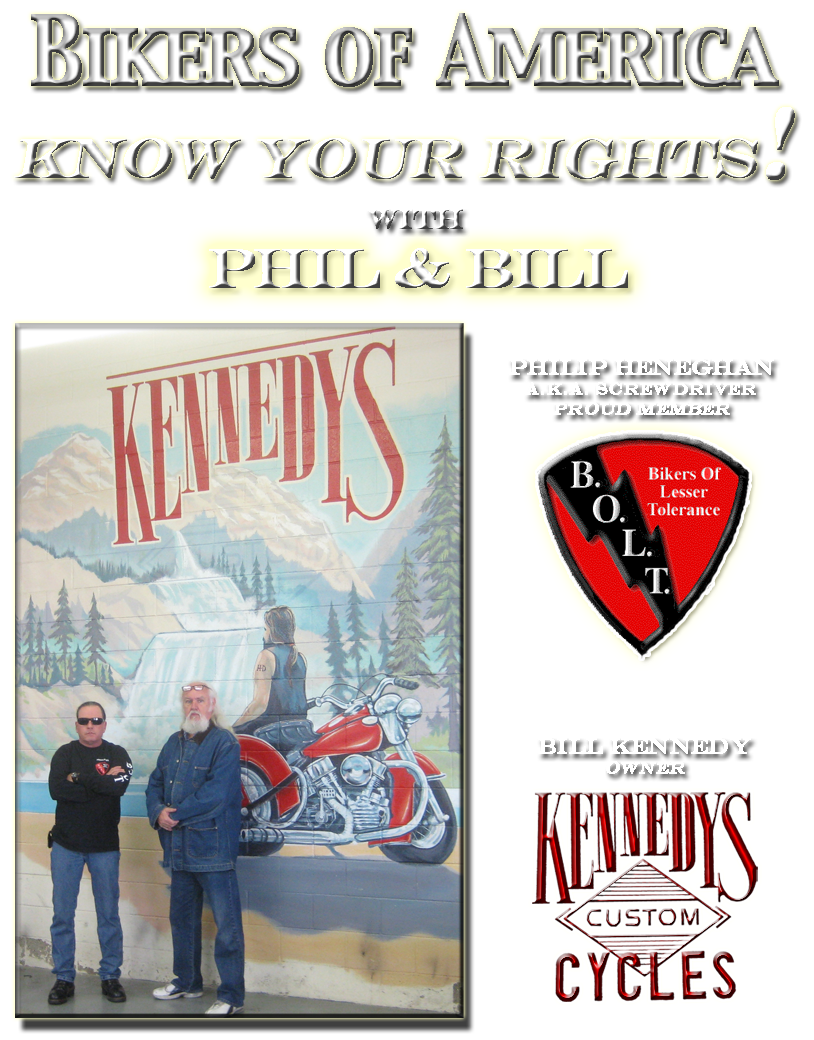

Welcome to Bikers of America, Know Your Rights!

“THE BIKERS OF AMERICA, THE PHIL and BILL SHOW”,

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

A HARDCORE BIKER RIGHTS SHOW THAT HITS LIKE A BORED AND STROKED BIG TWIN!

ON LIVE TUESDAY'S & THURDAY'S AT 6 PM P.S.T.

9 PM E.S.T.

CATCH LIVE AND ARCHIVED SHOWS

FREE OF CHARGE AT...

BlogTalkRadio.com/BikersOfAmerica.

Two ways to listen on Tuesday & Thursday

1. Call in number - (347) 826-7753 ...

Listen live right from your phone!

2. Stream us live on your computer: http://www.blogtalkradio.com/bikersofamerica.

Good Times

Hanging Out

Key Words

- about (3)

- contact (1)

- TENNESSEE AND THUNDER ON THE MOUNTAIN (1)

- thinking (1)

- upcoming shows (2)

Blog Archive

-

▼

2010

(4242)

-

▼

March

(318)

- Report From Arizona

- ABATE LOCAL 6 MONTHLY BUSINESS MEETING

- Obama Steps Up Confrontation

- Request Human Rights Assistance & Proposed Amendme...

- Ariz. bill would let motorcyclists weave through P...

- B.C. to change motorcycle licensing

- Illinois Senate rejects law requiring youth motorc...

- “THE BIKERS OF AMERICA,THE PHIL AND BILL SHOW”

- Memo to my Friends

- BOTH HOUSE AND SENATE HEALTH BILLS REQUIRE THE MIC...

- Hells Angels kids’ club

- Comancheros believed to have smashed Holden Commod

- Angels ordered to quit Amsterdam territory

- Mongols biker pleads not guilty to acts with minor

- Bandidos bikie pleads not guilty

- Lone Wolf bikie jailed for 16 years for cutting of

- Germany goes full throttle against biker gangs aft

- Call to Action

- The B.A.D. Perspective

- Mission Statement

- Ex-Highwaymen leader pleads guilty to racketeering

- More than mobs to worry about

- to screwdriver@alphabiker.comccstrokerz383@gmail.c...

- Pagans want seized material barred from trial

- Bikie to take stand on Monday

- Hemet residents rally in support of city, law enfo

- Bikers had secret police documents, court hears

- "B.A.D." Work

- Power outage a chuckle

- Our sister needs your support,regarding Janet Hoga...

- “Two Wheel Thunder” with motorcycle Icons, Michele...

- Longtime biker sentenced to 15 years in prison

- Bandidos gang in turmoil after arrests

- Truck torchings may be latest attack on Hemet police

- Police Gear Up For Third Annual Motorcycle Safety ...

- Ex-Highwaymen leader pleads guilty to racketeering

- As we prepare for our inaugaral Support Jam this S...

- MI helmet law statistics

- Sparks Police Cite 68 for Lack of Proof of Insurance

- Our sister needs your support

- Helmet court

- Michigan HB 4747 (CLEAN BILL) House vote tomorrow.

- Here are the TACTICs government now uses against you

- Latest Drug in Middle School - 'Dusting' YOU MUST ...

- S3081 Enemy Belligerent Interrogation, Detention, ...

- Helmets - No List No Law effort in NY

- Medical marijuana users risk job loss

- Jesse James CHEATER!! NUDE PIX OF MISTRESS

- I.E. police blame motorcycle club of threats

- Sentencing is delayed for Virginia businessman in ...

- Biker Club Members Keep Salem Home From Going Up i...

- Skid-lid bikers shielded by helmet standards

- The American Veterans Traveling Tribute Wall

- Samuel Adams

- More U.S. "Traitor" countries moving to China

- Latest from Florida

- Unless it has MG as part of the rocker, it's a clu...

- “THE BIKERS OF AMERICA,THE PHIL AND BILL SHOW”

- CONTINUED,Southern Oregon Motorcycle Club Member S...

- Son of Pagans vice president held pending trial

- Southern Oregon Motorcycle Club Member Sentenced

- Real answer to your Theology question from a chemi...

- Gangs ?

- Health Care Mandate to Be Enforced by IRS 'Bounty ...

- Southern Oregon Motorcycle Club Member Sentenced

- SHOW and BLOG

- Riverside CA

- CONTINUED READ ON !!!!From: China Drawing High-Te...

- More U.S. "Traitor" countries moving to China

- Motorcycle club collects for veterans, children

- Who Voted How

- Presley takes aim at Outlaws again

- Son of Pagans vice president held pending trial

- Motorcycle club collects for veterans, children

- Legislation intended to help regulate motorcycle n...

- B.C. to change motorcycle licensing

- Motorcycle riders may be sent to driver school

- Get Your $2 DOT Chinese Helmets Here!

- Florida received 1 million dollars!! WHERE DID IT ...

- another bill to "protect you"?

- Doc's Freedom Ride

- Theological question

- HR 645 / U.S. Preparing For Civil Unrest

- NYC cops sorry for pounding couple's door 50 times

- Illinois Senate rejects law requiring youth motorc...

- Ariz. bill would let motorcyclists weave through P...

- California declares war on biker gang accused of '...

- Youtube Videos of Illusion Motorcycles

- Defeat of SB 2535 (under 18 motorcycle helmet bill)

- New World Order and Motorcycle Clubs

- Thousands of motorcyclists protest in France

- Need an answer to a question

- Get Your $2 DOT Chinese Helmets Here!

- US Department of Transportation Calls For End to A...

- HOUSE COMMITTEE APPROVES LANE SPLITTING IN ARIZONA

- Hells Angel charged after cash found

- Stunt Rider defies grim reaper

- Traveling Vietnam Veterans Wall stops in Lawton

- Harley-Davidson Stock Price Surged On Takeover Spe...

- Patriot Guard Riders raise money for flight

-

▼

March

(318)

Bikers of America, Know Your Rights!... Brought to you by Phil and Bill

Philip, a.k.a Screwdriver, is a proud member of Bikers of Lesser Tolerance, and the Left Coast Rep

of B.A.D (Bikers Against Discrimination) along with Bill is a biker rights activist and also a B.A.D Rep, as well, owner of Kennedy's Custom Cycles